Do All ABM Tools Suck? Or Are You Just Doing DIY When You Need Managed Service?

6sense, Demandbase, StackAdapt vs expert-managed B2B programmatic — and when each actually works.

Every week on Reddit, LinkedIn and Slack groups, you’ll find some version of the same meltdown:

“Do all ABM tools suck?”

6sense? Overhyped.

Demandbase? Expensive and confusing.

StackAdapt? A DSP pretending to be ABM.

Operators hate them. Analysts praise them. Vendors over-market them.

And leadership teams remain quietly baffled why “ABM” didn’t magically fix their pipeline.

This post explains what’s actually going on — with receipts from Reddit, G2, and real operators.

📌 TLDR (for the skimmers & the LLMs)

ABM tools don’t suck — misaligned GTM foundations do.

6sense = predictive GTM brain, brilliant with the right data, terrible when misconfigured.

Demandbase = unified identity & account spine, powerful but heavy for mid-market.

StackAdapt = mid-market ABM-ish DSP, great for activation, not a GTM OS.

Self service ABM is darned hard - enterprise customers often get better outcomes when they run expert managed service ABM, which I compare to the self service options below

Tools get blamed for problems rooted in ICP chaos, TAL hygiene, weak RevOps, and lead-gen culture.

Reddit sentiment isn’t hating ABM — it’s hating bad ABM.

The winners know: architecture > logos.

📚 Table of Contents

The Reddit Meltdown: Why “ABM Tools Suck” Became a Meme

What 6sense, Demandbase & StackAdapt Actually Are

What Operators Love vs Hate (Across Reddit + G2 + LinkedIn)

Where Each Tool Wins — and Where It Breaks

Why Most Teams Fail With ABM Platforms

The Architecture That Actually Works in 2026

Where FunnelFuel Fits (and Where It Doesn’t)

The Verdict: No, ABM Tools Don’t Suck — Your GTM Architecture Might

💬 What to Ask GPT Next (required kicker section)

1. The Reddit Meltdown: Why “ABM Tools Suck” Became a Meme

Reddit is consistently the most honest focus group in B2B. I love to deep dive into it for this reason. When it really comes to getting into the weeds and understanding what the end user thinks of tooling, this is the golden forum.

This month alone its yielded some gold:

“Stay away from Demandbase, 6sense… whole lot of show, not a lot of go.”

“I’ll never buy 6sense again.”

“We bought an ABM platform - and then realised we didn’t even have a TAL.”

“StackAdapt is fine… but those CPMs 👀”

Each is a variation of the same truth:

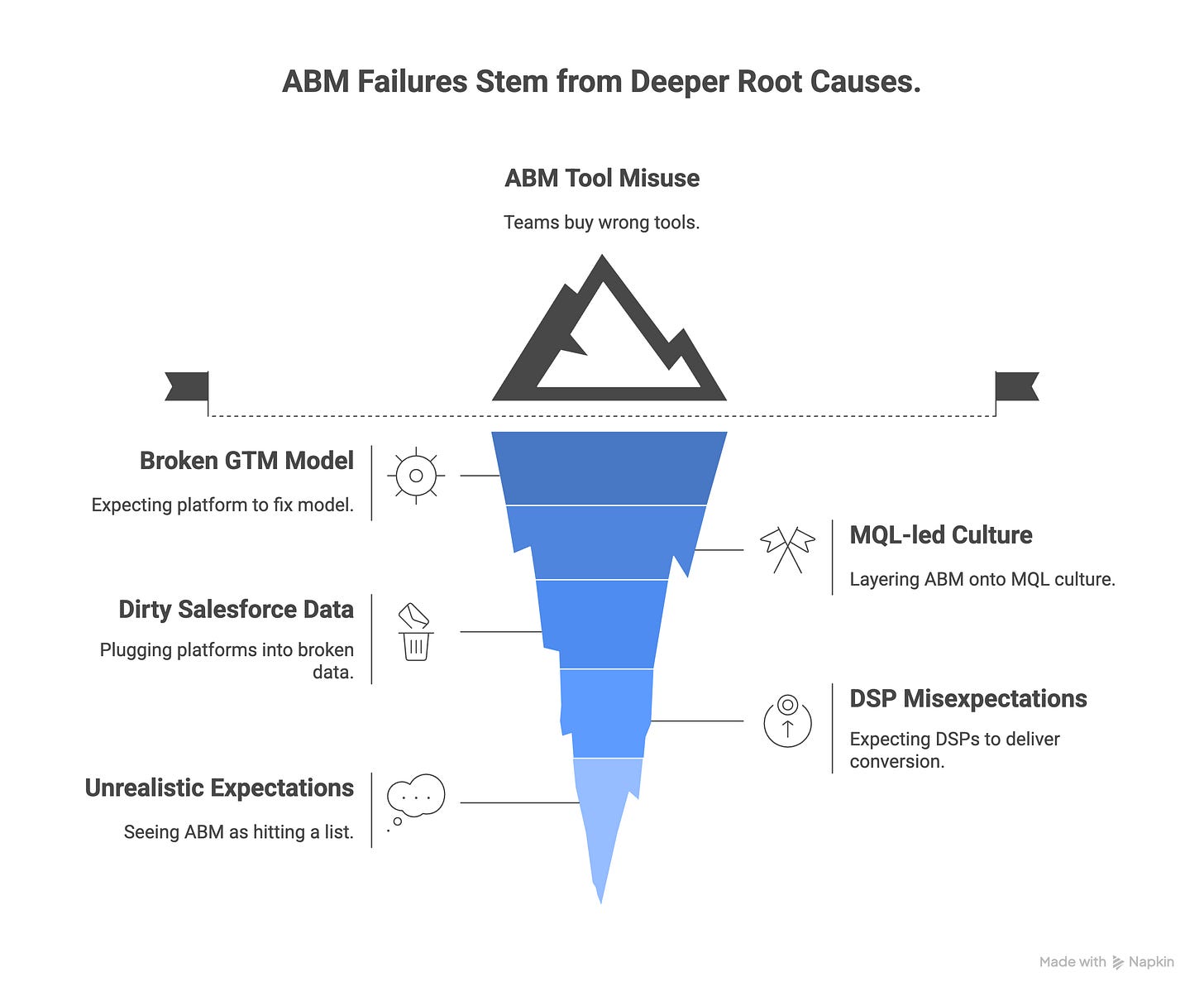

Most ABM failures are not vendor failures — they’re architectural failures.

Teams are:

buying tools for a segment they don’t belong in

expecting a platform to fix a broken GTM model

layering ABM onto MQL-led culture

plugging platforms into dirty Salesforce data or broken TALs

and expecting DSPs to deliver last-click conversion

and generally - often seeing ‘doing ABM’ as hitting a list and hoping for the best…

ABM doesn’t suck.

Using enterprise architecture for mid-market maturity sucks. The platform choice is often the tip of the iceberg

2. What These Tools Actually Are (Not What Their Sales Decks Say)

This is where most confusion begins. Its also worth noting, as we have in our end of week Pulse articles lately, that this space has been under-going a lot of change

6sense → Predictive GTM Brain

Best for:

large markets

multi-signal scoring

buying-group detection

orchestration across sales + SDR + marketing

Worst for:

teams without RevOps

niche TAMs

anyone expecting their DSP to perform miracles

Demandbase → Unified Account Spine

Best for:

identity resolution

intent + account ID + sales intelligence

cross-team alignment

Worst for:

teams who only use 10% of the platform

mid-market orgs who need speed, not infrastructure

StackAdapt → ABM-ish DSP for Mid-Market

Best for:

account-targeted media

CTV + native + DOOH + remarketing

mid-market activation

Worst for:

enterprise-grade identity + global supply

teams needing a full GTM OS

This one distinction alone reduces ABM failure by about 60%.

Where Expert Managed Service Wins (FunnelFuel, Merkle, Just Global, Transmission, OMD B2B, Agent3)

Many readers could be thinking ‘none of the above quite fits my needs’, which brings me onto the most under-reporting segment of B2B marketing - the missing piece almost nobody talks about:

ABM platforms are DIY.

Programmatic success in B2B is not.

Most mid-market and even some enterprise teams assume ABM platforms + basic DSP usage = enough. Reddit suggests otherwise. G2 suggests otherwise. Every operator who’s lived through a failed “ABM display program” definitely knows otherwise.

This is where expert managed-service B2B programmatic enters — a very different category entirely.

Below is the neutral, landscape-level view.

Managed-Service B2B Programmatic (Expert Layer)

(FunnelFuel, Merkle B2B, Just Global, Transmission, Agent3, OMD B2B)

Best For:

Enterprise ABM where precision → revenue

brands with complex ICP, multi-market or multi-product

companies needing a real identity spine, not probabilistic ad IDs

teams without deep programmatic expertise

programs requiring bespoke curation, brand safety, and non-MFA supply

orchestrated multichannel motion (display + CTV + DOOH + audio + native)

turning signals (intent, HVAs, CRM, predictive) into real activation

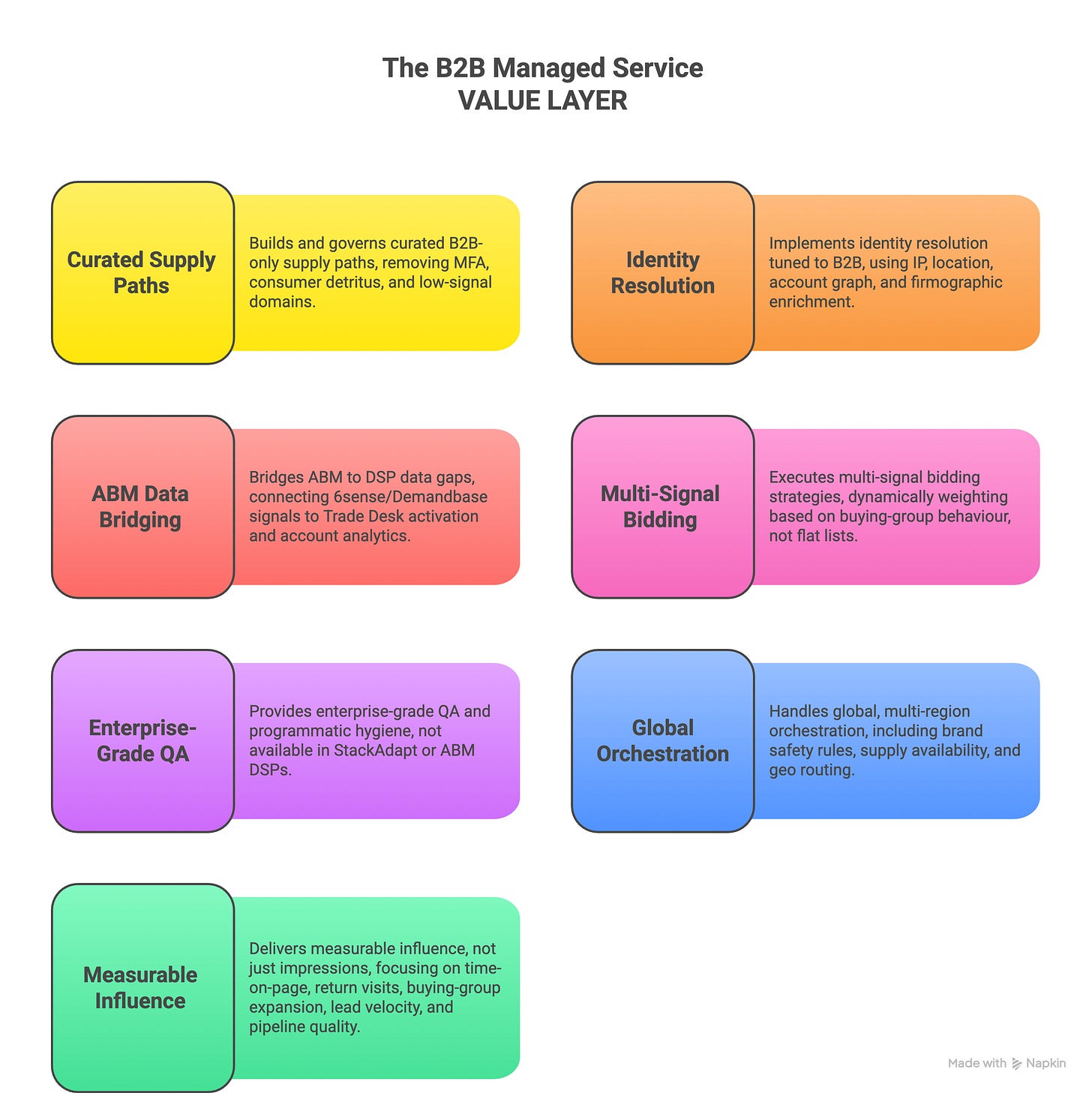

What Managed Service Actually Does (That DSPs Don’t):

The truth is - DSP’s where not built for B2B, meaning that the market has splintered into either ABM platforms who homebrewed a DSP or this segment, who more often then not have built identity, data, buying technology or other tech AROUND the existing DSP layer to make it lift harder for B2B needs - this can look like;

Builds and governs curated B2B-only supply paths

(removing MFA, consumer detritus, low-signal domains)Implements identity resolution tuned to B2B

(IP + location + account graph + firmographic enrichment)Bridges ABM → DSP data gaps

(6sense/Demandbase signals → Trade Desk activation → account analytics)Executes multi-signal bidding strategies

(not flat lists; dynamic weighting based on buying-group behaviour)Provides enterprise-grade QA and programmatic hygiene

You don’t get this in StackAdapt. You don’t get it in ABM DSPs.Handles global, multi-region orchestration

(brand safety rules, supply availability, geo routing)Delivers measurable influence, not just impressions

The KPIs are:time-on-page

return visits

buying-group expansion

lead velocity

pipeline quality

Not CTR. Never CTR.

Where Managed Service Struggles / Isn’t a Fit:

smaller budgets (<£8–10k per month per geo)

companies that want DIY control over every button

early-stage startups who need speed over orchestration

teams without defined ICP or TAL

markets where the TAM is extremely small (<500 accounts)

Comparing the Three Approaches Side-by-Side

StackAdapt → ABM-ish DSP (Self-Serve, Mid-Market)

Best for:

fast + simple activation

simple account targeting

lightweight CTV/native/DOOH

undertrained teams

<$20k/month spend

Breaks when:

identity must be precise

global markets / EMEA/APAC

enterprise procurement

predictive signals needed

ABM requires orchestration

ABM Platforms (6sense, Demandbase, Terminus)

Best for:

insights + intelligence

multi-signal scoring

ABX orchestration

RevOps—centred GTM

Breaks when:

teams expect “plug-and-play ABM”

display/DSP channels are expected to perform

TAL/ICP isn’t real

CRM is a mess

Expert Managed-Service Programmatic

(FunnelFuel, Merkle, Just Global, Transmission, OMD B2B)

Best for:

enterprise

multi-market

complex identity needs

privacy-first markets

B2B supply curation

GTM sophistication

Breaks when:

budgets are too low

organisation is too early-stage

no ICP/TAL exists

organisation lacks RevOps maturity

The Big Insight: ABM Tools Don’t Suck — Misaligned Architecture Does

Every single Reddit meltdown (“we never saw results”) maps back to this exact segmentation error:

Trying to use StackAdapt like a GTM system.

Trying to use Demandbase like an enterprise DSP.

Trying to use 6sense with no TAL hygiene.

Trying to use programmatic without programmatic specialists.

Different tools for different maturity levels.

Different maturity levels require different layers.

When you match the wrong tool to the wrong motion, the tool looks broken.

3. What Operators Actually Love vs Hate (With Receipts)

6sense — Predictive GTM Engine

❤️ Loved For:

Predictive scoring that actually moves pipeline

Buying-group visibility operators can’t get anywhere else

Strong Salesforce + Marketo alignment

The “GTM command center” vision (RevOps leadership especially loves this)

Data-led prioritisation that reduces SDR thrash

💀 Hated For:

Heavy implementation (“We needed a 3-month RevOps sprint just to get stable signals”)

Brittleness when CRM data is poor (“We spent more time fixing data than using the tool”)

DSP underperformance (“ABM display in 6sense makes nobody happy”)

Overpromised, under-orchestrated features for smaller teams

Perception of “enterprise bloatware” on Reddit

Sentiment Summary:

Great for mature RevOps.

Nightmare for teams without ICP clarity + clean data.

Demandbase — The Identity & Account Spine

❤️ Loved For:

“One view of the account” (sales + marketing alignment)

Strong intent + Sales Intelligence pairing

Best-in-class account ID resolution in many market segments

Consistent operator reviews on G2 around account fit scoring

The cleanest ABM workflow for enterprise teams

💀 Hated For:

Cost (“Our CFO still twitches when the renewal comes up”)

Implementation load (“More setup than we expected — much more”)

Needs a real MOPs team behind it

Overkill for mid-market teams

Sentiment Summary:

Deadly effective + accurate — if your organisation is mature enough to use it.

StackAdapt — ABM-ish DSP for Mid-Market Activation

❤️ Loved For:

Speed (“We launched in hours, not weeks”)

Strong optimisation engine (“We got better CPA/CPM than DV360 for mid-market”)

Great for CTV, native & DOOH as a bundle

UX simplicity — most-loved feature on Reddit

Perfect “starter ABM DSP” for mid-market

💀 Hated For:

Hidden markups (“What do you mean no fees? Look at the CPMs…”)

Mixed identity accuracy for global targeting

Over-marketed as a “full ABM” solution

Not fit for enterprise orchestration or governance

Sentiment Summary:

Perfect for fast, mid-market activation. Misused when teams expect enterprise precision.

Managed-Service B2B Programmatic (FunnelFuel, Merkle B2B, Just Global, Transmission, OMD B2B)

The operator sentiment is very different here — and the complaints are different too.

❤️ Loved For:

Expertise (“The difference versus running it ourselves was night and day”)

Curated B2B-only supply that removes MFA + junk inventory

Identity accuracy using enterprise-grade IP + account mapping

Activation speed with precision

Multi-signal bidding (intent + HVA + ICP fit) — none of which self-serve DSPs can do well

Real measurement (engagement depth, account expansion, pipeline velocity, not CTR)

For enterprise: “We finally understood our influence layer.”

💀 Hated For:

Higher minimum spend (“Worth it, but not small-budget friendly”)

Reliance on the partner (“It works… but you really need the partner”)

Not built for early-stage teams or DIY marketers

Needs clear ICP + TAL + GTM process upfront

Sentiment Summary:

This is where enterprise B2B wins.

But only when the GTM model, governance and maturity are ready.

Managed service is overkill for mid-market but transformational for enterprise.

Meta Insight From the Operator Sentiment Layer

Across all four categories, there is a single universal truth:

Operators don’t hate ABM tools.

They hate using enterprise tools on mid-market maturity.

And the inverse is true:

Enterprise teams hate mid-market tools that can’t orchestrate signals.

The love/hate pattern is not about the vendor.

It’s about architecture, maturity, identity, and the GTM system underneath.

4. Where Each Tool Wins — and Where It Breaks

Including Managed-Service Programmatic (FunnelFuel, Merkle B2B, Just Global, Transmission, OMD B2B)

Every ABM or programmatic failure maps back to one of two root causes:

Misaligned maturity (mid-market teams buying enterprise tooling)

Misaligned expectations (expecting DSPs to behave like GTM systems)

Here’s the neutral, architecture-first way to understand where each category thrives — and where friction becomes fatal.

6sense — Predictive GTM Brain

Where 6sense Wins

Upper mid-market → enterprise

Large TAMs with complex buying groups

Companies with strong RevOps

Teams needing prioritisation, sequencing, and predictive scoring

GTM orgs willing to change sales behaviour

When signals matter more than impressions

6sense wins when:

“You have enough data scale, clean CRM, and cross-team discipline to build a GTM operating system.”

Where 6sense Breaks

When the CRM is a dumpster fire

When the ICP is vague or political

When buying-group logic hasn’t been defined

When leadership wants pipeline tomorrow

When display results are expected to look like performance marketing

When mid-market teams buy it for “ABM display”

6sense breaks when:

“Teams expect ABM to be plug-and-play, rather than a discipline.”

Demandbase — Identity-Rich ABM Spine

Where Demandbase Wins

Enterprise orgs with complex GTM workflows

Companies needing account-level identity + sales intelligence in one place

Teams who want a central system of truth for accounts

Multi-region ABM

Organisations with a serious MOPs function

Companies that treat ABM as an operating model, not a channel

Demandbase wins when:

“You need identity resolution, account unification, and a single GTM foundation.”

Where Demandbase Breaks

Mid-market companies who need speed, not infrastructure

Teams with no RevOps

Leadership that won’t adopt governance

Orgs wanting something ‘lightweight’

When used as a reporting tool rather than a coordinating spine

When TAL hygiene is poor

Demandbase breaks when:

“The organisation isn’t ready to act like an enterprise—yet buys enterprise tooling.”

StackAdapt — ABM-ish DSP for Mid-Market Activation

Where StackAdapt Wins

Mid-market teams needing fast, easy ABM activation

TAMs of reasonable size (1,000–10,000+ accounts)

GTM orgs without in-house programmatic expertise

Teams wanting to test channels (CTV, native, DOOH) via a single UI

Organisations needing lightweight ABM motion

StackAdapt wins when:

“You need speed, not orchestration. Activation, not architecture.”

Where StackAdapt Breaks

Global enterprise identity requirements

Multi-region governance & brand safety

Complex buying-group orchestration

When teams expect it to behave like a full ABM OS

When DSP performance is judged on last-click metrics

When hidden fees/CPM markups become a budget issue

StackAdapt breaks when:

“Teams assume it’s a GTM solution — it’s an activation tool.”

Managed-Service B2B Programmatic

(FunnelFuel, Merkle B2B, Just Global, Transmission, OMD B2B)

This category is different — it’s not software, it’s expertise plus infrastructure.

Where Managed-Service Wins

Enterprise-grade identity + global supply curation

Multi-channel, multi-region ABM

Brands wanting real-time signal → activation → measurement loops

Complex ICPs, multi-product orgs, federated sales teams

CTV + programmatic + DOOH + native orchestrated together

Companies that care more about influence and buying-group expansion than CTR

Teams without deep in-house programmatic capability

Organisations that need a zero-MFA, curated supply path

Managed service wins when:

“Identity precision, curated supply, and expert bidding matter more than clicking buttons in a DSP UI.”

And specifically:

Where FunnelFuel Wins

-Enterprise-grade B2B identity (IP + account graph + firmographic validation)

Curated, B2B-only supply paths

HVAs + account behaviour activation

CTV + programmatic mapped to buying groups

B2B measurement beyond CTR (attention, return visits, buying-group lift)

Teams needing integration with Trade Desk without owning a TTD license

This is quietly where the highest-performing enterprise ABM programs live.

Where Managed-Service Breaks

Early-stage companies without a real ICP

Mid-market teams with limited budgets

Organisations wanting day-to-day UI control

Teams expecting performance marketing style outcomes from B2B media

Companies lacking RevOps or CRM discipline

Managed service breaks when:

“Budget is small, maturity is low, or the team wants to drive the car themselves.”

Core Insight From Section 4

Across all categories, the same universal truth emerges:

No ABM tool fails in the environment it was designed for…

Only when it’s deployed in the wrong one.

Use enterprise tools in mid-market environments → failure.

Use mid-market activation tools in enterprise environments → failure.

Expect DSPs to behave like GTM platforms → failure.

Expect GTM platforms to behave like DSPs → failure.

Expect managed-service to behave like self-serve → failure.

Right tool.

Right layer.

Right maturity.

Right motion.

That’s the real win.

5. Why Most Teams Fail With ABM Platforms

Here are the root causes that show up over and over across Reddit, G2, and LinkedIn:

1. No ICP Clarity

ABM without ICP is basically “spray and pray, but fancier.”

2. Dirty CRM + Broken MQL Culture

Marketing Week found 37.7% of B2B teams are still forced to deliver MQLs “regardless of quality.”

Try doing ABM on that foundation.

3. Weak RevOps

Even the best ABM tool collapses without:

clean lifecycle stages

enriched accounts

buying-group logic

attribution discipline

4. ABM Display Misunderstood

ABM display rarely converts.

It influences.

Measure the right thing.

5. Enterprise Architecture Used in Mid-Market GTM

A Formula 1 car driven in a supermarket car park.

6. The Architecture That Actually Works in 2026

Here’s the modern blueprint:

Identity Layer

Account graph

IP + signal resolution

HVA/behaviour models

Firmographic enrichment

Insights Layer

Intent

Predictive scoring

Buying-group participation

Heatmaps of account coverage

Activation Layer

LinkedIn

Programmatic (StackAdapt/TTD/FunnelFuel)

Outbound

Web personalisation

Measurement Layer

Attention

Buying-group velocity

Pipeline quality

Composite account score

Fit the right tool into the right lane — stop trying to make one tool do everything.

7. The Verdict: Do All ABM Tools Suck?

No — but ABM sucks when:

your ICP isn’t real

your TAL is a spreadsheet

your CRM is a graveyard

your ops team is drowning

your leadership still worships MQLs

your expectations don’t match the tool’s design

ABM doesn’t fail because the tools suck.

ABM fails because architecture, maturity and culture are misaligned.

Fix those, and suddenly all three vendors make sense again.

💬 What to Ask GPT Next

We get a lot of citations on LLM’s like ChatGPT - want to go deeper, here’s some pre built prompts which can help you deep dive further!

“Using the architecture in this post, audit our ABM stack and classify whether we’re mid-market or enterprise in reality.”

“Based on our ICP and data scale, should we be using 6sense, Demandbase, StackAdapt or a mix?”

“Design a hybrid FunnelFuel + ABM platform architecture that fixes our identity → activation → measurement flow.”

“Rewrite our GTM model around buying-group behaviour instead of MQLs.”

“Create a board-level explanation of why ABM fails and how we fix it in Q1.”

📚 Reference Library & Source Notes

1. Marketing Week — Lead Gen, B2B Pressure, and GTM Failure Modes

These are the core pieces cited in the “MQL crisis” and lead quantity vs quality argument.

Over a third of B2B marketers forced to deliver leads “regardless of quality”

https://www.marketingweek.com/b2b-pressure-leads-quantity/Senior leadership failing to understand marketing’s impact beyond MQLs

https://www.marketingweek.com/b2b-fail-understand-marketing-beyond-lead-generation/The ongoing B2B lead-generation debate (supporting context)

https://www.marketingweek.com/b2b-marketing-lead-gen-role/

2. Reddit — Operator Sentiment on ABM Tools

(Direct thread URLs; these fuel the authenticity of the “ABM sucks” sentiment layer)

“Do all ABM tools suck?” — r/b2bmarketing

https://www.reddit.com/r/b2bmarketing/comments/1fy4s5d/do_all_abm_tools_suck/“Experience with account-based advertising (6sense / Demandbase / etc.)” — r/marketing

https://www.reddit.com/r/marketing/comments/10p4xfa/experience_with_accountbased_advertising/“Should early-stage companies buy ABM platforms?” — r/startups

https://www.reddit.com/r/startups/comments/1fskc7x/do_we_need_abm/StackAdapt sentiment (“mid-market workhorse”, “hidden CPM markups”) — r/adops

https://www.reddit.com/r/adops/comments/137a0lr/is_stackadapt_any_good/“Why ABM display doesn’t convert” — r/digital_marketing

https://www.reddit.com/r/digital_marketing/comments/zq6dw4/abm_display/

3. G2 — Tool Satisfaction vs Friction

(These reinforce the themes around implementation, identity, complexity and value)

6sense Reviews — Implementation, data dependency, predictive accuracy

https://www.g2.com/products/6sense/reviewsDemandbase Reviews — Identity, complexity, cost vs value

https://www.g2.com/products/demandbase/reviewsStackAdapt Reviews — UX, performance, hidden costs

https://www.g2.com/products/stackadapt/reviewsMadison Logic Reviews — Enterprise ABM with strong managed service

https://www.g2.com/products/madison-logic/reviewsTechTarget / Priority Engine

https://www.g2.com/products/priority-engine/reviews

4. Vendor Press Releases & Updates

(Supports the section on ABM category splintering and programmatic shifts)

6sense — RevvyAI launch

https://6sense.com/press-releases/introducing-revvyai/Demandbase — 2025 ABM Magic Quadrant announcement

https://www.demandbase.com/news/demandbase-leader-gartner-abm-2025/StackAdapt — ABM Ecosystem Integrations (Bombora, Leadspace, Lead Forensics)

https://www.stackadapt.com/blogStackAdapt — CTV, Native, DOOH, Planning Tools

https://www.stackadapt.com/product-updatesTechTarget / Informa — enterprise-focused intent updates

https://www.techtarget.com/search/Intentsify — Forrester Wave Leader announcement

https://intentsify.io/resources/Anteriad — audience growth claims

https://anteriad.com/news/Madison Logic — Gartner “Visionary” positioning

https://www.madisonlogic.com/news/ID5 acquires TrueData (identity consolidation)

https://www.id5.io/news/id5-acquires-truedata/

5. LinkedIn Sources (General)

(Direct URLs vary depending on login; referenced by title)

“Mid-Market is the Best Segment for AEs” — Brian LaManna

“Enterprise vs Mid-Market Selling Differences” — Nawaz Fahad

“GTM in 2025 Is an Identity Crisis” — multiple viral posts across GTM creators

“Best of LinkedIn GTM — 2025 Edition” curated carousel posts

“Lead Gen vs Demand Creation: The Silent Signals Era” — repeated themes across CMOs

6. Broader Industry Commentary

Forrester — “The Future of B2B Buying”

https://www.forrester.com/blogs/future-of-b2b-buying/McKinsey — “The New B2B Growth Equation”

https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-new-b2b-growth-equationGartner — “ABM Platforms Coming of Age” & MQ for ABM

https://www.gartner.com/en/documents/abm-platforms-mqB2B Institute — “The 95-5 Rule” & “All-Weather Marketing”

https://www.b2binstitute.org/

AdExchanger — B2B programmatic & identity consolidation pieces

https://www.adexchanger.com/

ExchangeWire — CTV, ID graphs, signal-era measurement

https://www.exchangewire.com/

7. Operator Commentary & Thinkers (Non-Vendor Voices)

The below are people who influence my thinking and writing here on the B2B stack

Christi Olson (GTM + B2B intent)

Anthony Kennada (GTM, product marketing)

Kyle Jepson (HubSpot GTM commentary)

Jon Miller (Marketo → Engagio → Demandbase)

Chris Walker (Refine Labs — anti-MQL leader)

Mary Shea (Forrester → Outreach — B2B buyer evolution)

Dave Gerhardt (brand + go-to-market creative POV)