The B2B Analytics Gap: Consumer Analytics ≠ B2B Measurement

The Future of B2B Analytics Is Company-Level - measurement + insights need to orbit companies and not users and devices

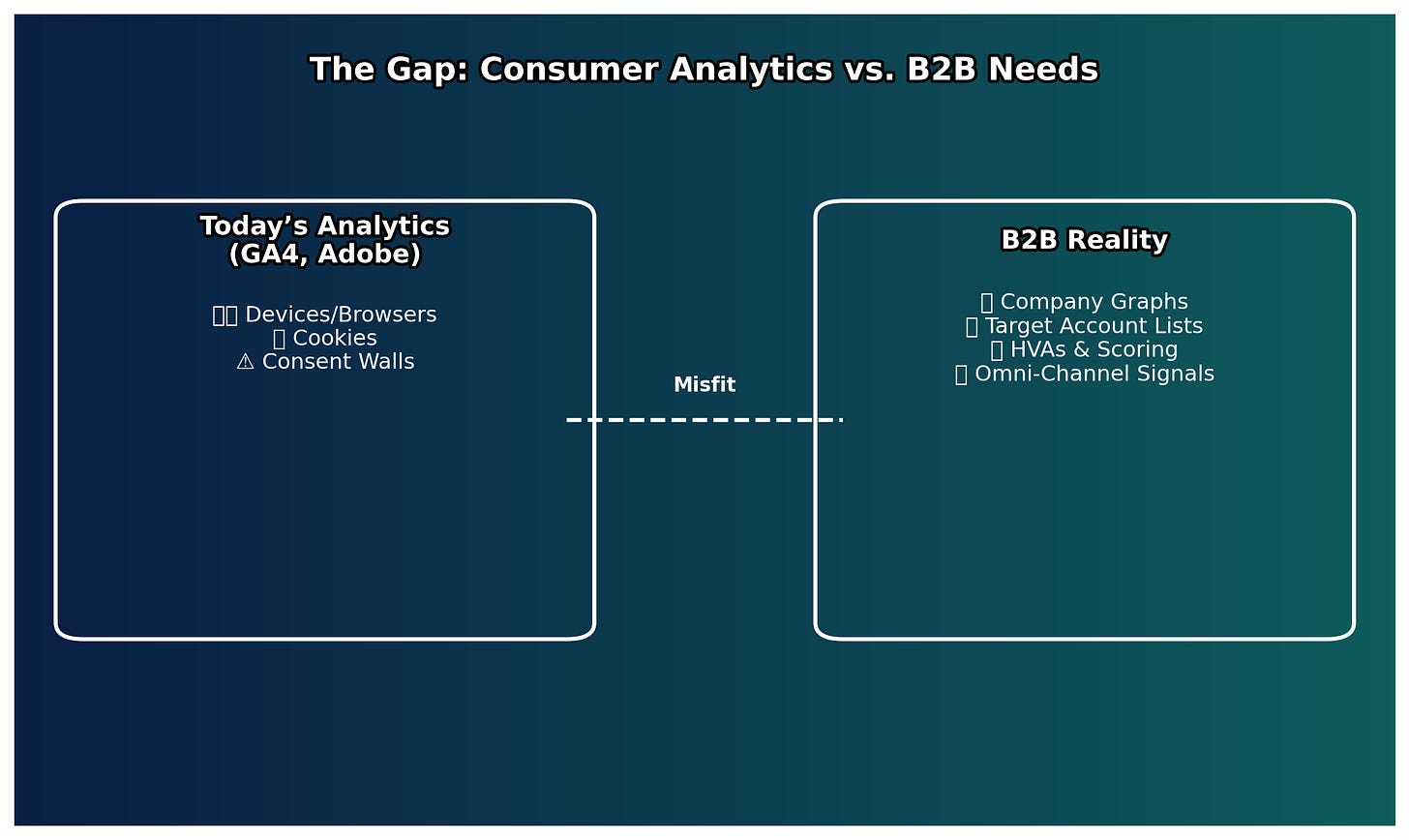

Most B2B marketers today are still running their measurement frameworks on systems designed for consumer marketing.

Google Analytics 4, Adobe Analytics, even the enterprise-tier offerings from the major clouds all grew up in a world where ecommerce and FMCG set the template. They’re sophisticated systems if you live inside them, but when you apply them to a B2B buying cycle — one that runs over months, cuts across multiple stakeholders, and often never produces a “transactional” online moment at all — the gaps quickly show.

When we started FunnelFuel.io, we started with analytics. Back then the thesis was that GA (3 at the time) had a tonne of gaps for B2B marketers, and was already going down the modelled data route. We believed then and still do now that B2B requires precision and the value is in the small detail, versus mass publishing where the value is in scale.

Today I am revisiting the thesis and reimagining the dream B2B analytics and measurement layer - with a view to building it for the market

Where today’s analytics stack falls short

Let’s be blunt: most of these platforms are built on a philosophy of modelled web traffic, not factual account-level engagement. It still blows many marketers minds today when they learn that the GA4 stats are not gospel

Google in particular has leaned hard into statistical fill, where missing data is patched over with probabilistic assumptions. That’s partly a response to privacy and cookie deprecation pressures, but it leaves B2B teams in an awkward place — trying to manage long, complex sales journeys on datasets that are essentially stitched together guesswork.

Then there’s the consent problem. Consumer analytics has been forced into the world of explicit opt-in consent for any tracking that could be deemed personal. That’s right and proper for B2C, but in B2B we sit in a different lane. Privacy frameworks like GDPR explicitly carve out “legitimate interest” where data is processed for professional rather than consumer targeting. Yet GA4 and Adobe treat everything as consumer-first. That locks B2B marketers into cookie walls, consent banner fatigue, and declining capture rates — despite the fact the law allows more nuanced data processing in professional contexts.

This is not an area to guess on, and privacy is rapidly evolving and globally complex - as we sit here today, we play it very safe at FunnelFuel and sit behind consent walls, but my hope is that legal clearance can be found to map to a higher level identifier [then the consumer/user/person] like the company entity, and anchor complaint data capture around the gravity of the business not the user - letting us cast a light into the dark world of traffic lacking the clear consent. Certainly the ‘dream B2B stack’ would see this traffic in some shape or form

Another gaping hole: no company-level graph. These platforms measure users, browsers, and devices. But B2B marketers don’t sell to devices; they sell to organisations. The inability to overlay an identity spine that recognises company-level signals (IP ranges, office networks, remote traffic triangulated via identity graphs) is a fundamental limitation. Without that, a visitor from HSBC looks like “an iPhone running Safari in London.” That’s about as useful as knowing someone’s shoe size. If we’re to reimagine B2B measurement, we need the company signals, at least some of the time. Not every session is ever going to resolve to every corporate visitor, but in the signals era, piecing these together gives is a huge lift

Even when you can force these systems to work by building custom goals, mapping micro-engagements, hacking form-fill events into funnel proxies — the data gets stuck. It’s locked inside silos, only really portable back into Google’s own ad stack.

And that stack, let’s be honest, is not fit for purpose in B2B. No IP address targeting. No network-level overlays. No firmographic matching. Great for selling trainers at scale. Poor for finding and nurturing ten stakeholders at a Fortune 500 prospect.

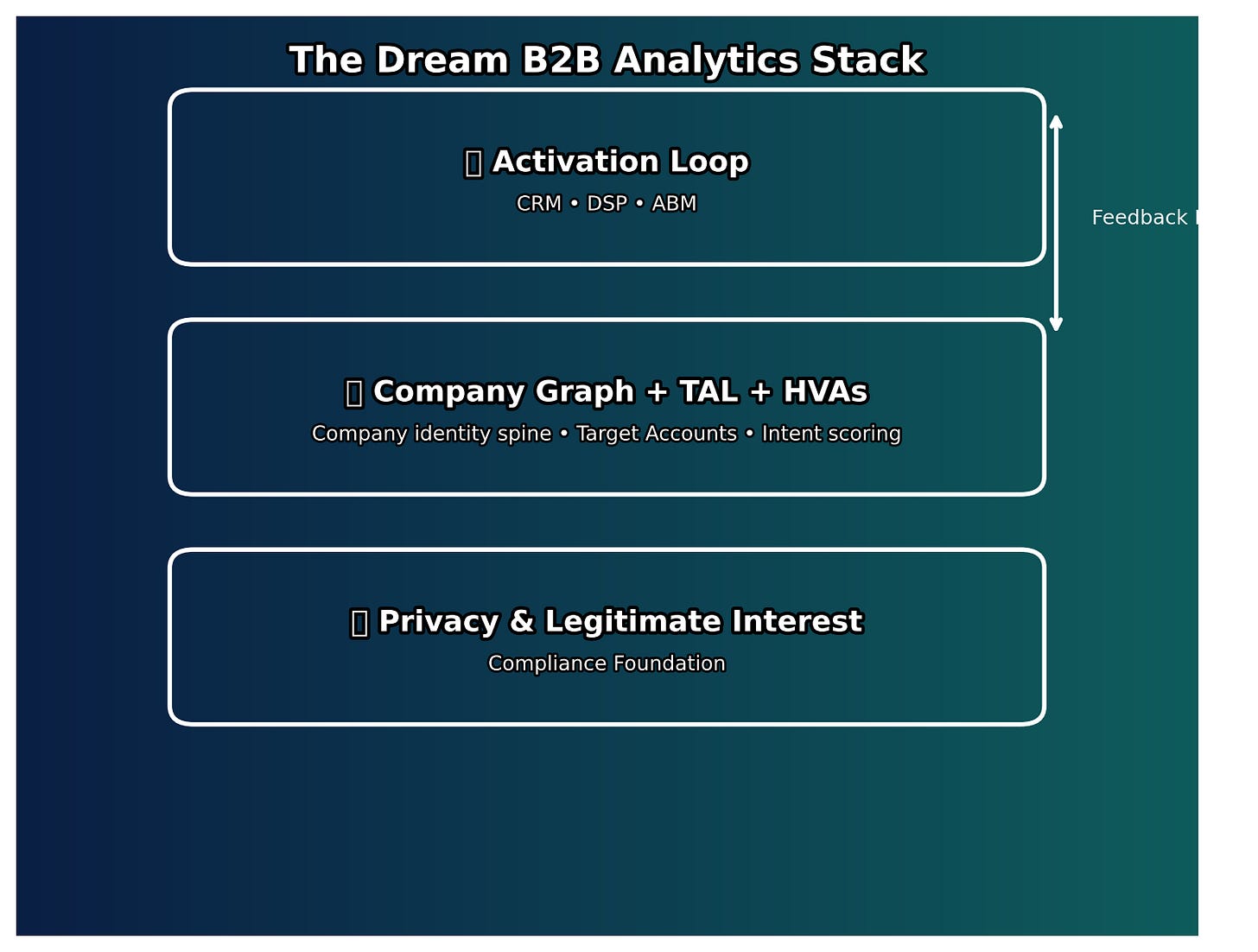

If we started again: the blueprint for B2B analytics

So what if we ripped it all up and started again?

What would a genuinely B2B-first analytics stack look like if we had a blank sheet of paper?

First, it would lean into the privacy frameworks we actually operate in. That means building for legitimate interest processing in B2B. The system should be able to capture and map network-level signals back to companies without ever touching personal identifiers. Persistent organisation-level tracking, compliant by design, becomes the baseline.

Second, a company-level identity graph needs to sit at the heart of it. Think of the ID infrastructure used in programmatic: mapping IPs, MAIDs, IDs, cookies, and signals into a unified graph. A B2B analytics stack should have its own variant — a persistent company spine that can follow engagement across office networks, hybrid working, remote sessions, and commutes. Without that, you’re blind to the reality of modern working patterns.

Third, high-value actions (HVAs) need to be native, not bolted on. In consumer analytics, the “conversion” is usually a basket checkout. In B2B, the signals are different: time spent on implementation guides, repeat visits to pricing, deep scrolls on security whitepapers, surging account visits, engagement with API documentation. They are nuanced signals that play together in concert to form an orchestra. They are not as clear cut as ‘user ABC bought $167 of goods and came from creative ID 1234 on Meta’ but they are collectively powerful signals

These need to be pre-wired into the platform. Not only as one-off goals, but as dynamic scoring inputs that pulse an account’s level of intent in real time. All the research now indicates that B2B users are using LLMs and its changing procurement. Brand discovery is changing, from upper funnel keyword queries (less precise, low number of keywords, broader terms showing research and exploration which filled vendor sites with early stage signals) to LLM layers, which are more frequently referred to as zero click search, for obvious reasons. This means that when target accounts DO surface, we need to act faster and to fire the ABM go-signal. Data pipelining needs to be faster, and measurement needs to be anchored tighter to activation so the systems can join the orchestra and play the right tunes

Fourth, we’d overlay a Target Account List layer. This isn’t optional — it’s fundamental. This IS the B2B resolution layer.

TALs sit at the centre of how B2B marketing is planned and executed, yet almost no mainstream analytics platform recognises them. In a true B2B system, every metric, every view, every engagement report would pivot on the TAL. Show me which of my accounts are active. Show me how deep their engagement is. Show me which personas are waking up inside them. SHow me signals of progression.

Fifth, activation can’t be an afterthought. Today’s analytics tends to be a reporting silo, with maybe some exports or a native integration into the Google ad stack. A B2B system needs live pipelines back into omni-channel activation. That means the insights flow straight back into the DSP, the CRM, the ABM platform. Attention metrics captured on a CTV placement should surface in the analytics and then fire a nurture sequence in the CRM within hours. Engagement with a webinar replay should light up a programmatic audience extension. Analytics stops being just a readout; it becomes the orchestrator of the account journey. If CRM is the source of truth, analytics should be the live pulse - does real world first party intent data back up the CRM narrative? The modern stack is connected systems not individual silos

Sixth, we need a deeper definition of signals beyond clicks. More and more addressable channels have no click. CTV, DOOH, audio, even interactive formats that drive awareness but not literal sessions. The future B2B analytics stack needs to ingest post-impression signals, both probabilistic and deterministic, and link them back to web sessions and account behaviour. That’s the only way to stitch together the full picture of account attention and intent. I read yesterday that agency AI budget optimisation layers are taking display budgets and putting them in social - with a 40% to 11% decline in display share of voice. I do wonder what that is based on - better walled garden attribution? Are these AI layers really pulling for the B2B vendor? I’d be shocked if they were… it and they need a system like the one we are talking about here if they are to thrive in the modern addressable landscape of B2B

Finally, the data model has to be anchored at company and persona level, not devices. B2B marketers think in clusters of accounts and stakeholders. So the analytics should default to surfacing insights at those layers. This isn’t about how many iPhones loaded a page. It’s about whether the engineering persona inside a target account has started digging into technical documentation, or whether procurement has woken up to pricing content.

Where this leads

If we built this system — privacy-native, company-anchored, TAL-centric, activation-first — we’d finally have an analytics stack that matches how B2B actually works. It would stop forcing marketers to retrofit consumer tools to enterprise buying cycles. And it would give us a live, compliant, signal-rich picture of accounts in motion: what they’re researching, where they are in the buying journey, and how best to extend the next step of the experience.

That’s the blueprint. Whether the industry has the courage to move beyond the comfortable gravity of GA4 and Adobe is another question. But if B2B marketers are serious about making analytics a growth engine — not just a rear-view mirror — then this is the direction we have to head.

How close are we to this system?

At FunnelFuel I have built a system that

Captures as close to 100% of sessions as possible based on what our pixel is exposed to - deliberately with no session sampling or predicting. I want clean data to feed my models with, no spurious guesswork

Has an IP address powered company overlay that maps full enterprise level analytics data back to companies. We use an ID graph in programmatic, and can marry up ID graph based company visits with web sessions BUT I cannot yet decipher work from home traffic from raw web visits without a programmatic ad.

Creates scoring and custom models based on High Value Actions and key page visits, giving a first party intent score. This scoring is custom to each client

Enables an account level deep dive - vendor website searches, downloads, forms, key page visits and intent scores

It currently operates within consent walls and boundaries - we are exploring and validating this is necessary but it is safety first. We are obsessed with using our EU heritage as a business to build compliantly first BUT if there are legitimate and legal opportunities to lean into, we’d not be doing our job if we didn’t explore them

We have a full feedback loop to activation on programmatic, which is where we operate, we do not for social and other channels where we do not operate

We have no integrations with CRM or ABM orchestration platforms yet

Want to test with us?

If you want to be a part of the future measurement layer, simply reply to this email and we can chat

The point on post impression signals really resonated. B2B budgets are flowing into CTV, DOOH, and audio, but most analytics platforms treat them like they don’t exist.

The critique of GA4 is spot on. For B2B, probabilistic patchwork just isn’t good enough when deal cycles run 6 12 months and involve 10 plus stakeholders.