The B2B Measurement Mismatch: Why Display Looks Broken (And Isn’t) & Why 2026 Could Be Programmatic's Comeback Year

Why B2B Is Optimising the Wrong Channels With the Wrong Metrics

For the last decade, B2B marketing has leaned on search as its most dependable truth source. Rightly so, as search is the one paid channel that has explicit intent as its input.

Search told us:

What buyers wanted

When they were active

Which messages worked

Which budgets were “efficient”

Search didn’t just capture demand, I’d argue that it explained it.

That era is ending. There’s little doubt that our best channels are starting to meaningfully contract. Organic search is being replaced with zero click journeys and precipitous drops in traffic. Organic LinkedIn fell off a clifftop from the pandemic era highs. Paid search is changing fast, going from explicit data to increasingly quiet data. Cookies killed display. Attribution is dead. A marketer in 2026 could be forgiven for feeling everything has gotten incredibly hard and every channel is going backwards.

Whilst that happened, the buyer journey completely changed. AI answers. Zero-click journeys. Aggregated intent. Private research loops, from industry Slack channels to private Whatsapp groups.

Buyers are still learning and researching, but they’re doing it without leaving the footprints which were so prevalent just a few years ago. And there’s intention here too, this is not ‘just’ technology obfuscating, it is buyers actively working in stealth mode too, knowing how the world works and working to avoid being chased with phone and email spam.

And while we’re busy arguing about SEO tactics and attribution models, something else has quietly happened and being recognised by a relatively small handful of the worlds leading agencies and vendors:

The real work of early-stage B2B influence has shifted elsewhere.

To display.

To native.

To programmatic video.

To environments we keep dismissing as “upper funnel.”

The problem isn’t that those channels don’t work.

The problem is that we’re judging them with KPIs designed for the end of the journey.

And all the while, in a world where the funnel is getting darker ever-faster, these channels are some of the very few that DO emit meaningful exhaust fumes and can work to rebuild the discovery engine that B2B is rapidly losing elsewhere

We’re buying early-stage influence with late-stage metrics — and then wondering why display “doesn’t work.”

This post is about that mismatch and why fixing it matters more in 2026 than almost anything else in B2B media.

1. Search Hasn’t Broken But It Has Stopped Teaching Us

Search still exists, obviously. Budgets still flow. Queries still get typed. And for all the noise around LLMs, traffic to Google and other major search engines is UP and other access points to search, like portals (yes those early internet 1.0 homepages) are also winning at the moment. Searches are very much still happening and at big scale

But the nature of search has fundamentally changed.

Buyers now:

Get answers without clicking into the sources of the answer, AKA, websites

Compare vendors inside AI summaries

Validate decisions before visiting websites

Move from question → confidence without a measurable session, which in the past, we would have worked to measure and capture as growing intent

The result isn’t just fewer clicks. It’s less signal.

Search used to be a teacher. It showed us what mattered, to whom, when and to an extent, why.

Now it often shows us:

The final confirmation step

The branded clean-up

The last visible moment before conversion

That’s not a failure of search. It’s a failure of our expectations. It also shows us that search is only giving meaningful signal at the last mile, and is not working to fuel the orchestrated marketing mix in the same way it used to

When search stops explaining demand formation, the rest of the system has to pick up the slack.

2. Where Demand Is Actually Being Shaped Now

Demand didn’t disappear when search went quiet.

It just moved earlier, quieter, and in some ways, sideways.

Look at what’s doing the heavy lifting now:

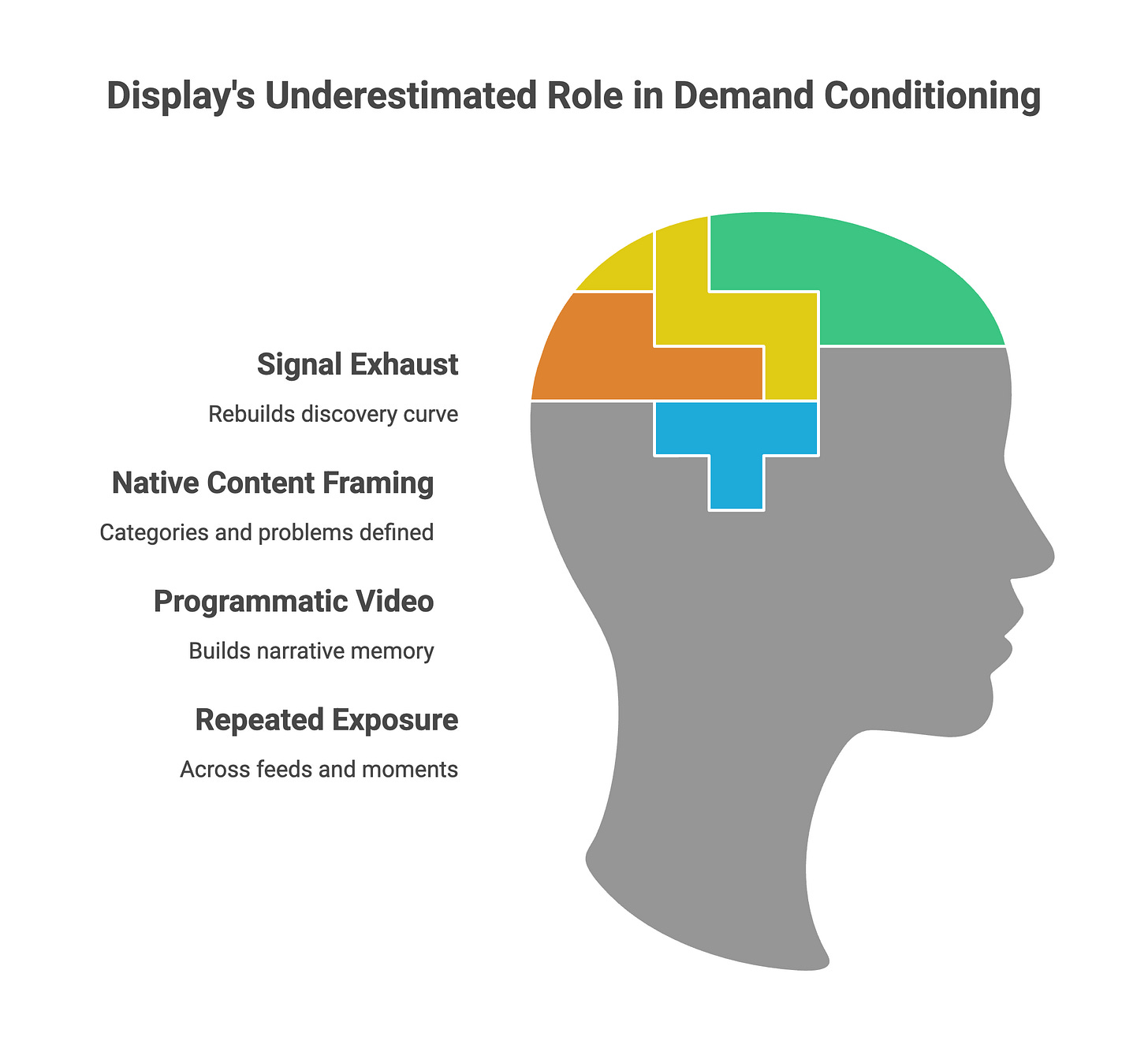

Display establishing early familiarity and throwing out signal exhaust fumes that rebuild the discovery curve

Native content framing categories and problems

Programmatic video building narrative memory

Repeated exposure across feeds, environments, and moments

These channels don’t close demand, but they sure as hell can condition it.

They shape:

What feels credible, trustworthy and in new areas of procurement, where psychology shows us first impressions matter - they give the chance to align a brand with a problem immediately, and create the whole “you don’t get fired by buying IBM’ - ie position a brand as the category leader

What feels familiar, because you have seen it before, and early in the learning curve where the synopses are set to learn and absorb

What gets shortlisted later, because of brand recall driven by the first two points

What buyers already “know” before they ever search

Display isn’t competing with search. It’s pre-conditioning it. This is how display can live up-stream of search, conditioning users towards branded queries faster and shaping the brands that are in the conversation

And yet we keep treating it like a worse version of paid search.

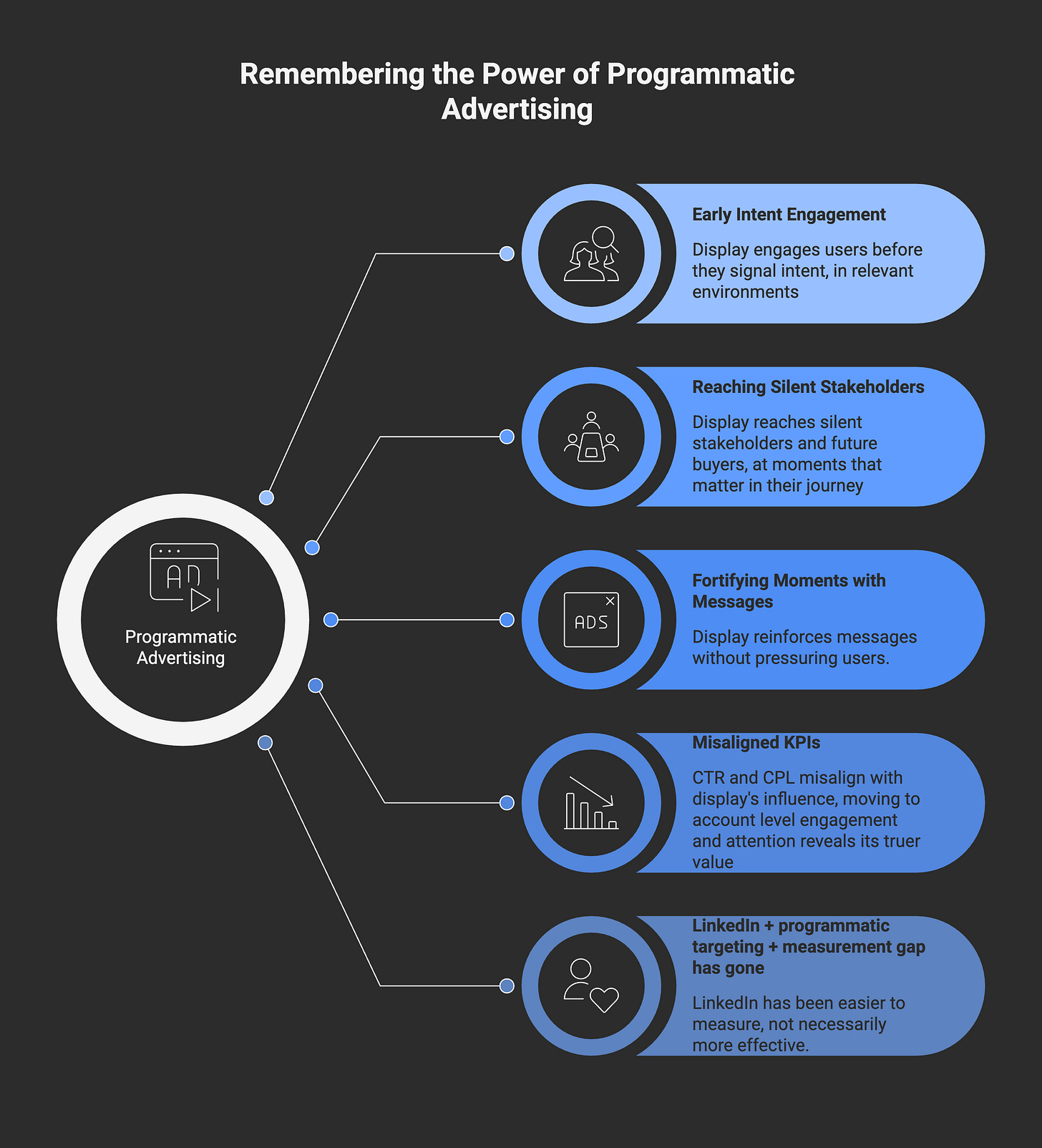

3. The Fatal Mismatch: Early Influence, Late KPIs

This is the core failure.

We ask early-stage channels to do late-stage jobs, and then punish them for failing. I think its an increasingly well recognised problem in B2B marketing, we know we’re using the wrong metrics yet we continue to use them because of a perceived lack of alternative.

Display, native, and programmatic video are still optimised against:

CTR

Post-click conversions

Last-touch attribution

Cost-per-lead logic

But their real contribution is:

Familiarity

Mental availability

Message absorption

Account-level progression

Those things don’t spike on a dashboard. They accumulate quietly. The slight irony is that as the bigger vendors were moving to measure more valuable metrics like High Value Actions (micro conversions on their websites), attribution died a brutal death.

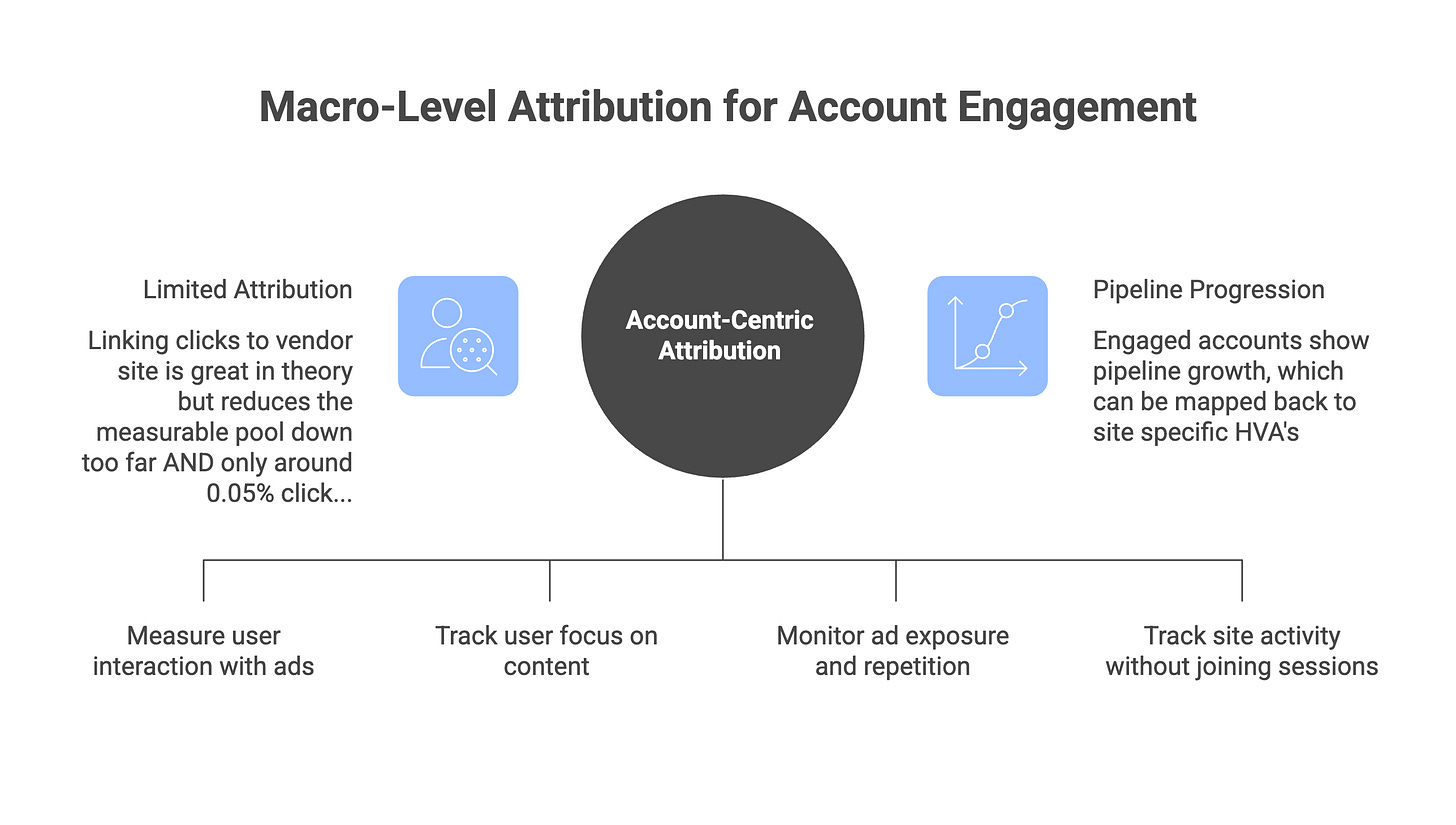

So then we ended up trying to link the minority of users who click, to the even smaller number that land on the vendor site, to the minor number of HVA’s exhaust fumes, right when post impression tracking died with cookies and the chance to link impression to session went with it. This is close but no cigar. The real win is thinking more about accounts engaged with ads - engagement scoring, attention metrics, reach, frequency value scoring etc and then monitoring the account behaviours on site and anywhere else they can be monitored - WITHOUT trying to join the sessions. The join is the misnomer where we push too deep into attribution; what matters is - on a bigger macro scale, do the accounts we engage with the messages we’re using start to show pipeline progression? if yes, tick the attribution box because to be honest, it won’t get better then that

When we focus too much on attributing he unattributable, or when we judge early influence by late outcomes, we create three predictable results:

Channels look inefficient or full on ‘don’t work’

Budgets get pulled back

Demand formation gets weaker

Then channels like display get blamed for “low intent.”

The system eats itself.

Display doesn’t fail because it doesn’t work.

It fails because we ask it the wrong question.

4. Why Programmatic Video Gets Treated Like “Cheap CTV”

Programmatic video sits in an awkward middle ground.

It’s:

Too visual to be treated like display

Too fragmented to be treated like TV

Too measurable to be left alone

Too early-stage to look good on last-click dashboards

So we do the worst possible thing.

We treat it as:

Discount CTV

Or premium display

Or a retargeting layer

Instead of what it actually is:

A distinct influence surface with its own job.

Video does narrative work.

It compresses explanation.

It builds memory faster than text.

It creates recognition before intent.

But because it doesn’t convert cleanly, it gets optimised into mediocrity.

Not because it’s ineffective but because it’s misunderstood.

5. How LinkedIn Became the Default (And the Risk That Comes With It)

LinkedIn didn’t win because it’s the only channel that works.

It won because it emits clean signal.

Clear audiences

Obvious clicks

Legible reporting

Familiar attribution

In a world where search was already going quiet, LinkedIn felt safe. It’s a topic I covered on LinkedIn below - click the picture to see the full post - which looks at LinkedIn versus display. When LinkedIn was the only show in town that brought the ABM targeting and reporting layer, it made a tonne of sense. Now that is very much doable in display, and display gives you the critical extra signal of environment (context that the reader was reading about) AND it does it cheaper… the pendulum has more than swung and its why leading vendors are redirecting their spend to channels like display that bring best in class signal insights back

But clean signal is not the same as full influence.

LinkedIn captures demand beautifully. It just does less to create it than we like to admit.

When B2B stacks over-rotate toward legibility, they sacrifice reach, frequency, and early narrative shaping — then wonder why growth plateaus.

— Paid Section Begins —

Everything above explains what’s breaking.

The real question is what replaces it. And how do we leverage that replacement to beat our competitors in 2026 and beyond