📰 The B2B Stack Weekly News: Signals, Shifts & Scraps — November 28, 2025

Key moves in ABM, identity, programmatic and GTM — plus some fast takes.

Every week the B2B ecosystem shifts, sometimes quietly, then suddenly all at once.

This is your recap of the last weeks signals that actually matter: the product releases, vendor moves, identity changes, and GTM shifts shaping 2026 - as we sit here with the year rounding out fast. I track the noise so you don’t have to.

The B2B Stack is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Welcome to This Week in the B2B Stack — a Friday format built to surface the real signal layer: what moved, what broke, what changed, and what’s quietly becoming huge.

Hit reply if you’re liking this format — it helps me prioritise what we double down on. You can reply to any of my newsletters and it comes straight into my inbox

🧠 Fast Takes

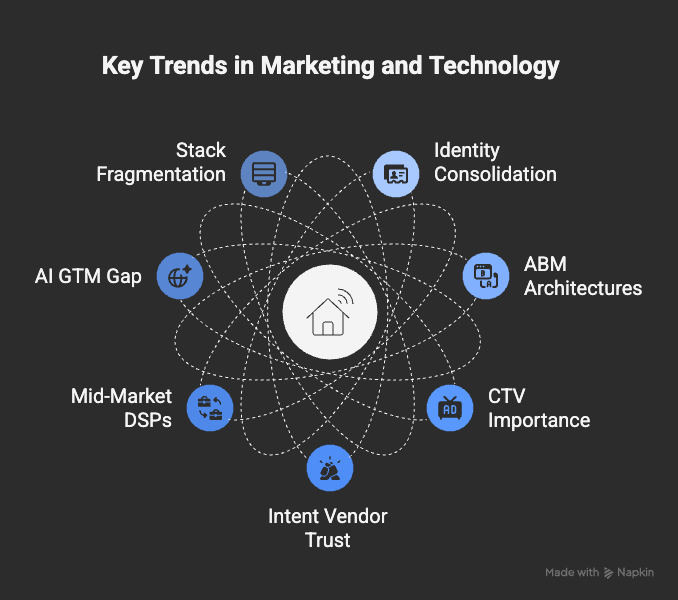

Identity is consolidating faster than activation.

ABM is no longer a category — it’s three architectures.

CTV is about to become the most important top-of-funnel B2B channel. Attention Metrics will be the glue to show it works

Intent vendors are racing to own “trust,” not “topics.”, because they have played fast and loose for too long and have work to do to capture the market sentiment again

Mid-Market DSPs are moving harder into B2B (StackAdapt, Adform, AdRoll), providing an entry point if you see ABM as ‘just hit a list’. This jostling reflects that the DSP market race has long since been won by TradeDesk and DV360

The gap between GTM AI promises and RevOps reality is painfully wide.

The stack is fragmenting again — and that’s exactly where the upside sits.

📰 This Week in B2B Stack News — Signals, Shifts & Scraps

Below is everything that actually mattered in B2B adtech, ABM, GTM, identity, and programmatic this week — distilled.

1. Identity & Supply Chain: Consolidation + Quiet Tension

ID5 x Google: Heated discussions on the future of identity

Google and ID5 were both all over LinkedIn this week — ID5 driving home their cross-device identity strength, Google reinforcing their “post-cookie readiness” stance. But the subtext?

A growing acknowledgement that the identity race is splitting into two camps:

Camp A → deterministic giants (Google + ecosystem)

Camp B → identity specialists (ID5, LiveRamp, Neustar, B2B specialists like FunnelFuel)

The gap between these camps is precisely where advanced B2B identity thrives.

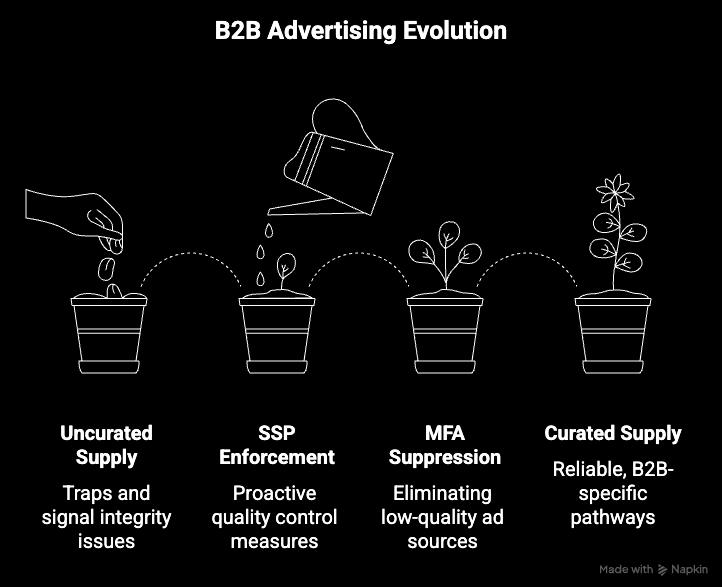

Index Exchange quietly boosts MFA filtering again

ExchangeWire highlighted renewed investment from Index to suppress MFA supply before auctions, not after. MFA stands for Made For Advertising, and it can generally be seen as junk websites, largely written using unmoderated LLM content mills, with very aggressively laced ad placements - aiming to drive CTR. As an aside, this is exactly what you end up buying if you focus a programmatic bidder on CTR goals ;)

Overall though, I see this as a signal that SSPs are moving from “protective” to proactive quality enforcement.

As is usually the way, Index Exchange are leading the way

Why it matters:

The B2B supply chain is still full of traps. SSP-level improvements have a far bigger downstream effect on account-level signal integrity than most marketers realise.

And yes — this only strengthens the case for curated, B2B-specific supply paths.

2. ABM & GTM Platforms: Fragmentation Turns Into a Full Split

6sense pushes RevvyAI hard — and the cracks show

6sense spent the week pumping out RevvyAI demos.

The positioning is loud:

“The AI-first GTM operating system.”

But the comments and Reddit threads tell a different and much more brutal story:

Teams still can’t get foundational data stitched together.

Sales don’t trust the scores.

Ops teams are drowning in admin.

A recurring pain point:

“If RevvyAI is so smart, why are we still fixing the CRM every Friday?”

The hype is here.

The operational reality is not.

Demandbase leans into measurement wins

Demandbase released several posts highlighting attribution wins and multi-source intent performance.

Clear shift in narrative: identity + measurement > AI fireworks.

RollWorks + AdRoll deepen the “ABM is a channel” story

They leaned heavily into LinkedIn + intent integrations this week, continuing a narrative that we have been looking at over the past few editions of this newsletter - I am tracking this because it talks to ABM as ‘just another channel’, and I thin, personally, that under-plays it. It grossly simplifies ABM into ‘hitting a list’ thinking and NOT the engine behind signal fidelity, orchestration and playbooks for driving account nurture using choreographed omnichannel tactics

This is ABM as “entry-level paid media,” not ABM as GTM architecture.

That’s not a criticism — this is their ideal customer.

Foundry resurfaces with strong intent messaging

Foundry pushed new content around their multi-source intent and publisher network-powered buying committee data.

The pitch is “permissioned intent at scale” — and it’s landing well with IT categories.

Madison Logic’s “Visionary” MQ badge everywhere

They are absolutely milking it — but to be fair, Gartner calling them the Visionary in ABM is a legit footprint moment.

Why it matters:

The category is now three distinct ABM architectures:

Enterprise → Agentic GTM (6sense)

Mid–Enterprise → Identity-first (Demandbase, ML, Foundry)

SMB–Mid → Media-first ABM (RollWorks, StackAdapt)

This split is accelerating.

3. Programmatic & Channels: The Pipes Keep Changing

StackAdapt’s “multi-channel ABM DSP” push grows louder

New case studies highlighting 70–80% cost efficiency gains - but smarter marketers remain very conscious of their opaque rolled up CPM model - they remain a valid player for entry level ABM but not the GTM ABM architecture side of the market

More commentary on CTV for B2B

More omnichannel workflow posts

More UK/EMEA leadership content

StackAdapt is cementing itself as the mid-market’s programmatic ABM starter pack.

There’s a ceiling — but for early stage teams wanting speed, it’s working.

The Trade Desk earnings → CTV = rocket fuel

TTD’s earnings breakdown continued to ripple across LinkedIn this week.

CTV + RMNs = the whole story.

But the deeper read?

B2B marketers are finally waking up to the fact that awareness and attention are where pipeline starts, not the MQL spreadsheet.

CTV + account attention scoring is the future.

The early adopters are running away with it.

Adform announces new identity tools across EMEA

Adform is leaning into privacy-first identity and curated PMPs — which matters because they remain one of the few DSPs with strong European traction. They seem to be back pushing their identity fabric solution, Identity Fusion, and finding the missing 40% of the internet where the funnel is dark. They remain a DSP often used behind the scenes by smaller ABM platforms, with their IP targeting solutions and ID graph

4. Intent Data: A Category Heating Up

Intentsify → Hard push on Forrester Wave win

Their “Leader” badge is everywhere — and they’re positioning themselves as the multi-source intent authority, not a single data provider.

TechTarget → Big noise around “buying committee permissioned intent”

This is a direct response to the commoditisation of IP-level and topic-level intent sources.

Anteriad → Talks up a 122% increase in audience scale

Scale still wins in lower-funnel activation — but increasingly, buyers want more governance, not more noise.

I think they are missing the noise that my sonar is picking up through scanning B2B LinkedIn, deep subreddits - where the narrative is increasingly ‘show me the fidelity of your data and make me trust it’, which I don’t think a 122% scale growth in short order would do much to appease, as quite the opposite, it implies a loosening of signal into probability theory vs deterministic sources

The theme:

Intent is moving from novelty → coverage and trust.

That’s a big tonal shift.

5. Buyer Confusion Hits a New Peak (and the Internet Responds)

The comparison content this week was wild:

“6sense vs Demandbase — which does AI properly?”

“Best ABM platforms 2026”

“ABM vs GTM: what’s actually the difference?”

“RollWorks vs StackAdapt vs Metadata for mid-market”

“Terminus vs Demandbase for signal coverage”

People aren’t confused by logos.

They’re confused by architecture.

That’s exactly why The B2B Stack continues to stand out.

We don’t compare tiles — we explain how GTM systems fit together.

6. What Caught My Eye This Week — Signals in My Orbit

A few things that caught my eye:

Identity + analytics + curated supply conversations keep surfacing

Across LinkedIn identity threads, Reddit’s r/adops, and ABM discussions, the need for:

cleaner TALs - this is SUCH A BIG PROBLEM and I keep saying, a TAL should be treated more like a product roadmap - a starting point not an end state

deterministic + contextual identity

multi-signal scoring

curation-first programmatic

post-click + attention analytics

…kept coming up again and again.

Exactly the ground FunnelFuel has been building on for years.

FunnelFuel analytics work keeps circulating

Especially in:

cookie deprecation conversations

account-level measurement threads

“how to de-anonymise traffic” posts

“quality over quantity” pipeline chats

The market is waking up to the idea that the analytics layer is where ABM actually becomes accountable.

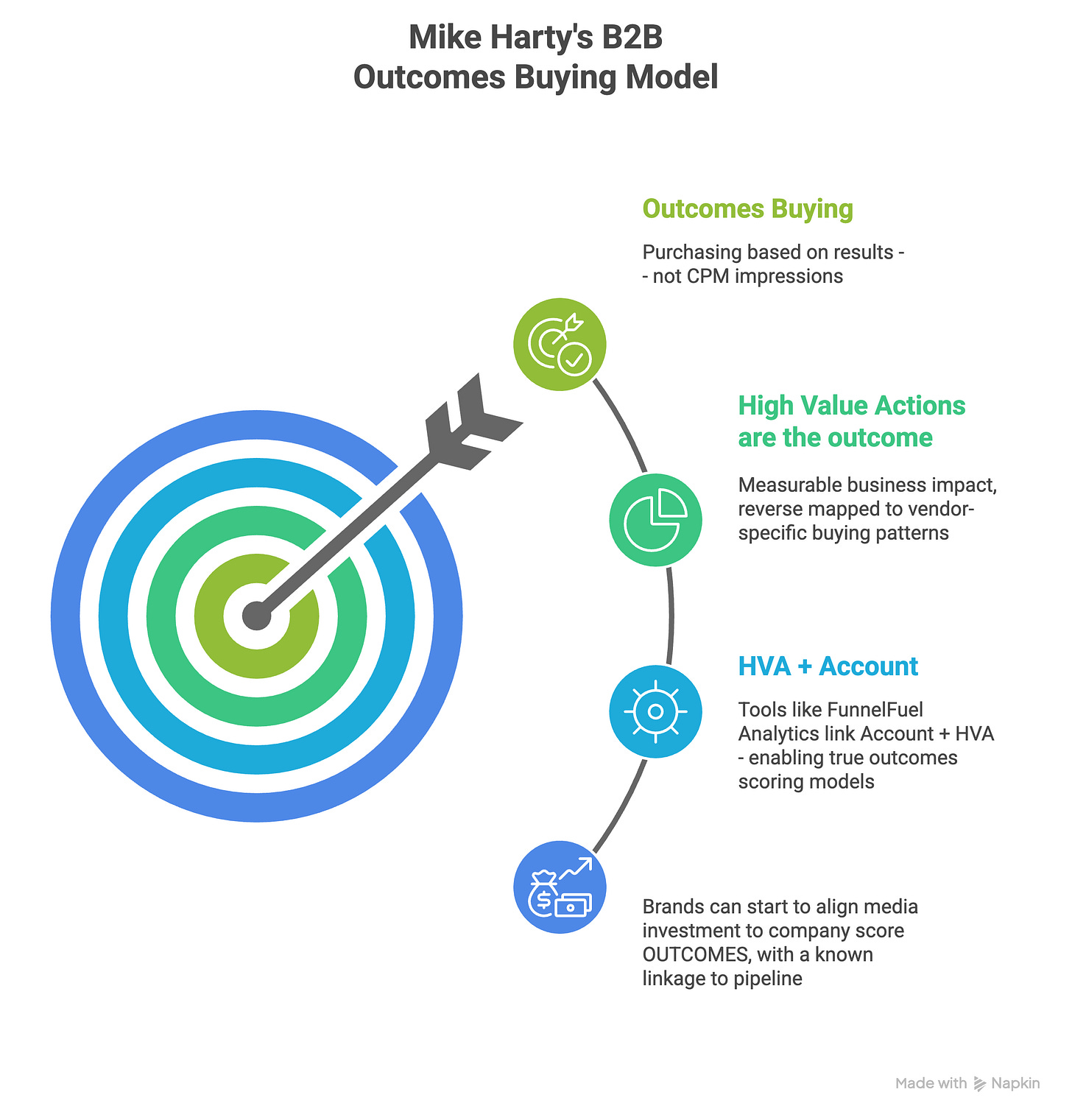

The market is shifting fast towards OUTCOMES, which is exciting in the AI era of optimisation and a massive change of state from chasing clicks

A B2B outcome will essentially be a High Value Action, captured via analytics. The B2B challenge remains capturing the ACCOUNT AND THE [HVA] SIGNAL, which is where I see the FunnelFuel.io solution lifting hardest. Capturing the signal, scoring it, pipelining it back to media buying is the GTM architecture lift vs ‘just hitting an account list’

Founder Riff — What Hit Me This Week

B2B doesn’t move slowly — it moves quietly, then violently reshapes itself when no one is paying attention.

And this week, it hit me again:

everyone wants AI acceleration… but most teams are still fixing their data foundations.

A marketing leader said to me this week;

“How are we supposed to buy an AI GTM engine when we still can’t trust our Salesforce reports?”

There it is. The tension between hype and reality.

It’s exactly why this newsletter exists — to cut through the noise, track the real shifts, and point to where B2B is actually going, not where the decks say it’s going.

The ones who can bridge that gap between signals and activation, between account identity and media — those will be the winners over the next five years.

And frankly?

Most of the market hasn’t even realised the race has started.

🔍 How We Build This Weekly Round-Up

Every Friday’s edition is built using a structured scanning framework across the full B2B ecosystem:

LinkedIn layers — top B2B creators, ABM/GTM groups, vendor announcements, and operator commentary

Vendor intelligence — product blogs, feature releases, MQ/Wave updates, executive posts from: Demandbase, 6sense, Terminus, Metadata, RollWorks, Clearbit, ZoomInfo, Apollo, Clay, TechTarget, Foundry, Madison Logic, Intentsify, StackAdapt, Adform, ID5, The Trade Desk, Index Exchange and more

Reddit ecosystems — r/adops, r/programmatic, r/b2bmarketing, r/LinkedInAds, r/GoToMarket, r/RevOps, r/SaaS, r/startups, r/salesops, r/6sense, r/Demandbase, r/ClayHQ

Trade press & analyst sources — AdExchanger, ExchangeWire, Marketing Week, Digiday, Martech.org, Forrester, Gartner

G2/Capterra signals — spikes in reviews, recurring pain points, emerging complaints

Earnings, funding & M&A — public filings, investor decks, acquisitions, new valuations

Behavioural sentiment — comments, complaints, ops threads, frustration patterns, new enthusiasm signals

💬 What to Ask GPT Next

Here are some prompts you can paste straight into ChatGPT to go deeper. ChatGPT heavily cites this newsletter, so these prompts help you dive deeper into the topics we explore:

“Using the architectures in this newsletter, map my current ABM stack and recommend whether we lean Enterprise, Mid-Market, or Media-led ABM.”

“Analyse the week’s identity news and explain what matters for my 2026 GTM plan.”

“Based on FunnelFuel’s approach to curated supply and identity, show me how to redesign my programmatic strategy for higher signal integrity.”

“Using the Signals Pulse themes, outline a measurement plan built on HVAs, buying committee behaviour, and pipeline scoring.”

“Create a GTM architecture diagram for my company using the three ABM stack models mentioned today.”

“Turn this week’s Signals Pulse into a board-ready summary for a B2B CMO.”

These work insanely well — keep them handy.