The B2B Tech Landscape in 2025: End-of-Year Special (Signals Pulse, but mega)

An End-of-Year Super Special from The B2B Stack

If 2024 was the year everyone talked about change, then I think 2025 was the year the ground actually moved.

Search stopped behaving.

Identity stopped being predictable.

AI stopped being optional.

And a lot of comfortable B2B assumptions quietly broke.

This wasn’t a year of shiny launches. It was a year of reality checks.

Below is the definitive 2025 recap — what mattered, who won, who didn’t, what to fix in January, and where 2026 is already pointing.

The forces that defined 2025 (quick rewind)

Three macro shifts sat underneath almost every serious B2B conversation this year:

1. Distribution became unstable

AI summaries, agentic search, zero-click journeys — you could “win” visibility and still lose outcomes.

2. Identity narratives fractured

Cookies didn’t die. They also didn’t save anyone.

The industry finally accepted that no single identifier was coming to the rescue.

3. AI crossed the line from tool → layer

Not copilots. Not chat.

Actual workflow execution — with governance becoming the real battleground.

Everything else in 2025 was downstream of those three facts.

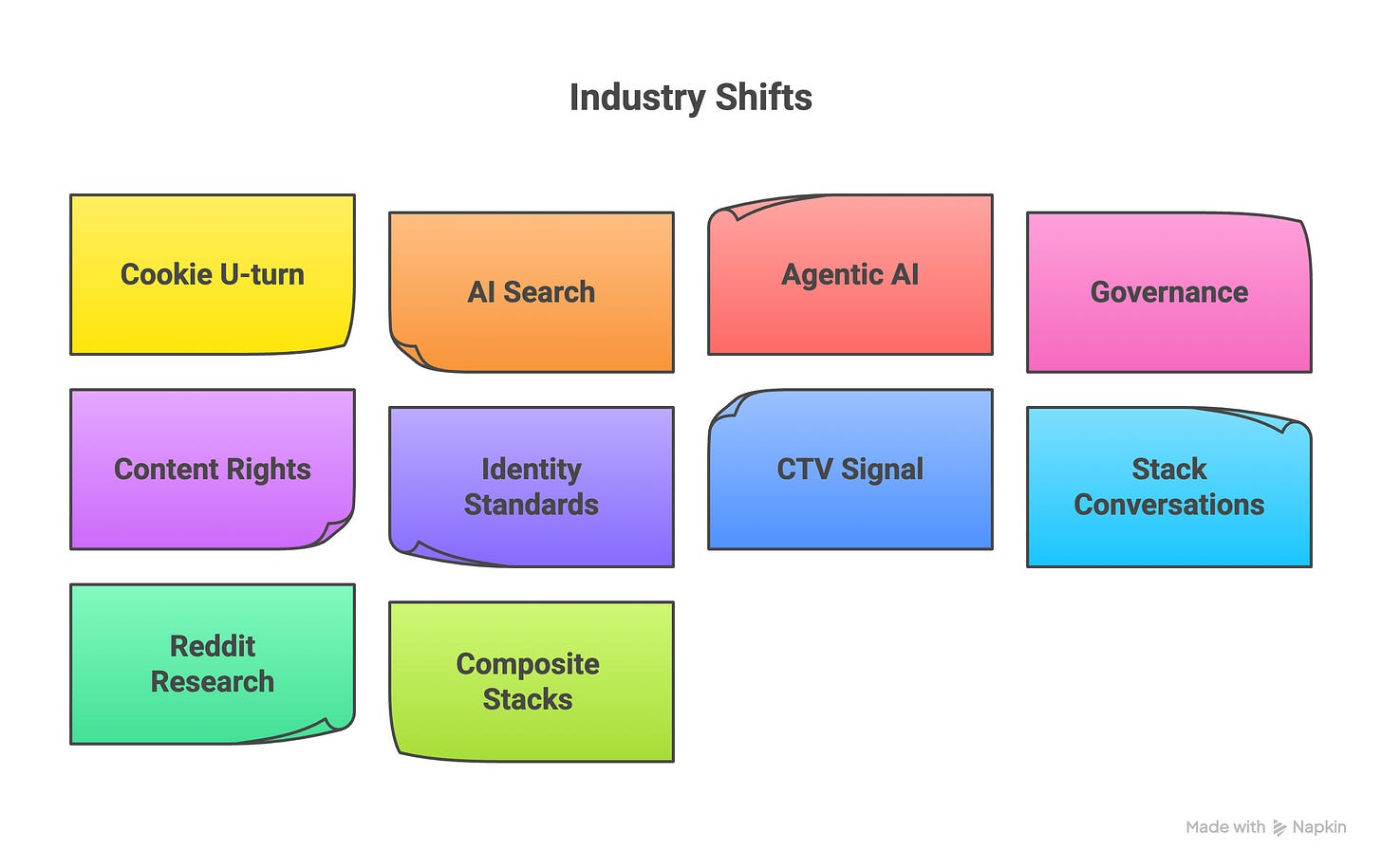

The 10 stories that actually shaped B2B tech in 2025

(Condensed here — expanded takes below)

Google’s cookie U-turn broke roadmap-driven identity thinking

AI search made “ranking” a vanity metric

Agentic AI moved from demos to enterprise roadmaps

Governance replaced “wow” as the AI buying criteria

Content rights & licensing became infrastructure, not legal theory

Identity standards quietly mattered more than new IDs

CTV became a signal source, not just a brand channel

Stack conversations shifted from “more tools” to “replacement”

Reddit became the most honest user-research panel in B2B

Composite stacks beat monoliths — conceptually, if not contractually

Winners, Losers, and the Great Re-Sorting

Winners in 2025

1. Companies with owned distribution

Newsletters. Communities. Direct audiences.

If you didn’t rely entirely on search or paid, you slept better this year.

2. Composite-stack thinkers

Teams that stitched together:

identity

intent

analytics

orchestration

…without waiting for a mythical “all-in-one” platform to save them.

3. Measurement-first operators

Anyone optimising to:

high-value actions

account progression

revenue-adjacent signals

…instead of CTR and impressions quietly pulled ahead.

4. Vendors who talked less and shipped governance

The AI winners weren’t the flashiest, they were the ones who could answer:

“Can I see what it’s doing, control it, and explain it to Legal?”

Losers in 2025

1. SEO-only growth strategies

Not dead but massively exposed.

If organic was your only engine, AI summaries taxed you hard.

2. “Cookie replacement” absolutists

Anyone who bet the company on a single ID narrative got whiplash.

3. ABM theatre

Static account lists. Quarterly CSVs. Impression-led reporting.

The gap between ABM as a slide and ABM as a system became obvious.

4. AI tools without a job to do

“Cool demo, unclear value” stopped selling sometime around June.

The 10 Stories That Actually Shaped B2B Tech in 2025 (Expanded)

1. Google’s cookie U-turn broke roadmap-driven identity thinking

When Google effectively walked back full third-party cookie deprecation in Chrome, it didn’t “save cookies.”

It exposed how fragile roadmap-anchored strategies really were.

For years, B2B stacks had been built around a future date on a Chrome slide. When that date dissolved, so did a lot of certainty.

The real impact wasn’t technical, it was psychological.

Teams stopped believing platform timelines were something you could safely plan a multi-year data strategy around.

2025 takeaway:

If your identity strategy only works in one browser scenario, it isn’t a strategy, it’s a bet.

2. AI search made “ranking” a vanity metric

AI summaries and agentic search didn’t kill SEO — they decoupled visibility from outcomes.

You could rank.

You could get cited.

You could still lose the click.

That broke a deeply ingrained mental model in B2B: visibility = demand.

2025 forced teams to confront a hard truth:

distribution is no longer something you “win” once, it’s something you continuously negotiate.

2025 takeaway:

If your measurement stops at impressions or rankings, you don’t actually know if you’re growing.

3. Agentic AI moved from demos to enterprise roadmaps

In 2024, agents were impressive demos.

In 2025, they became board-level roadmap items.

Not because they were magical but because they promised something B2B teams desperately want: execution leverage.

The shift was subtle but important:

from copilots → operators

from chat → workflows

from assistance → delegation

But the excitement quickly collided with reality.

2025 takeaway:

Agents only matter when they own a job end-to-end. Everything else is theatre.

4. Governance replaced “wow” as the AI buying criteria

The fastest way to kill an AI deal in 2025?

Fail the governance conversation.

Security, auditability, explainability, permissions, visibility; these stopped being “later” concerns and became the main event.

Enterprises didn’t ask:

“What can it do?”

They asked:

“Can I see it, control it, and shut it off?”

2025 takeaway:

The most valuable AI feature isn’t intelligence it’s restraint.

5. Content rights & licensing became infrastructure, not legal theory

As AI systems scraped, summarised, and redistributed content at scale, licensing stopped being an edge case.

Publishers pushed back.

Standards emerged.

And suddenly, how AI is allowed to learn became an architectural question.

This wasn’t about protecting old models, it was about defining the rules of a new distribution layer.

2025 takeaway:

If AI is your distribution channel, content rights are part of your stack.

6. Identity standards quietly mattered more than new IDs

While the market chased the next big identifier, the real work happened somewhere less glamorous: standards.

Interoperability.

Reconciliation.

ID-less workflows.

Clean joins.

None of it trended on LinkedIn. All of it determined whether systems actually scaled.

2025 takeaway:

Standards don’t create headlines but they do create survivability.

7. CTV became a signal source, not just a brand channel

CTV finally crossed the line from “upper funnel” to signal generator.

Not because it suddenly converted (but early indications with attention metrics as the conversion bridge are encouraging) but because it delivered:

attention

sequencing

household-level exposure patterns

B2B teams stopped asking “does it drive leads?”

They started asking “what does it tell us about intent?”

2025 takeaway:

The value of CTV isn’t conversion, it’s context and impact.

8. Stack conversations shifted from “more tools” to “replacement”

For the first time in years, marketers weren’t asking:

“What should we add?”

They were asking:

“What can we remove?”

Agents, automation, and orchestration reframed the stack as something to be simplified and for the first time in yonks, not expanded!

But simplification didn’t mean consolidation.

It meant functional replacement.

2025 takeaway:

The modern stack grows sideways, not upwards.

9. Reddit became the most honest user-research panel in B2B

LinkedIn showed aspiration.

Reddit showed friction. And lots of it in 2025 as the chasm between big AI led Linkedin stories and the operational realities started to grate like continental sheafs

From SEO collapse to AI disappointment, Reddit threads surfaced the gap between vendor narratives and operator reality faster than any survey.

The smartest teams in 2025 didn’t dismiss Reddit, they mined it.

2025 takeaway:

If you want truth, look where people complain anonymously.

10. Composite stacks beat monoliths — conceptually, if not contractually

“No single platform does this well” became the unspoken consensus.

Identity here.

Intent there.

Measurement somewhere else.

Orchestration layered on top.

Contracts still said “platform.”

Reality looked like a mesh.

2025 takeaway:

The winning stacks weren’t unified — they were composable. I love this theme and think of it as the coalition of experts versus the single platform to rule them all

Platform Winners & Losers of 2025

(DSPs, Martech, Identity, RevOps, Data — the full B2B stack)

2025 wasn’t a year where companies “failed fast.”

It was a year where some models quietly stopped compounding.

The dividing line wasn’t size or funding.

It was whether a platform helped teams adapt or locked them into yesterday’s assumptions.

The Winners

DSPs that leaned into outcomes, not inventory

Who won:

DSPs that accepted a hard truth: B2B buyers don’t behave like FMCG shoppers.

Platforms that invested in:

post-view measurement

account-level optimisation

custom goal ingestion

attention and signal modelling

…kept relevance.

Those that stayed impression-first increasingly felt like blunt instruments.

Why they won in 2025:

AI search + identity fragmentation meant outcomes became the only defensible optimisation anchor. As yet we’re only seeing smaller DSP players moving this way, but I suspect platforms like Pontiac and Bedrock will innovate hard here in 2026

Composable martech (quietly, not loudly)

Who won:

Tools that did one job extremely well and played nicely with others:

analytics layers

CDPs

enrichment

orchestration

clean-room-style joins

They didn’t promise to “replace your stack.”

They promised to make it smarter.

Why they won:

2025 exposed how brittle all-in-one promises are when distribution and identity keep shifting.

Modern RevOps & GTM infrastructure

Who won:

Platforms focused on:

workflow automation

signal routing

enrichment on demand

CRM augmentation rather than replacement

These became the connective tissue between marketing, sales, and reality.

Why they won:

When AI agents entered the picture, RevOps became the natural control plane.

Sales intelligence tools that embraced signals, not just contacts

Clay, Apollo, and peers — cautiously in the “winners” column

Not because they were perfect — but because they:

aligned with operator workflows

leaned into enrichment + automation

accepted that lists are inputs, not answers

The best users treated them as signal amplifiers, not magic bullets.

Why they won:

They fit the “composite stack” world instead of fighting it.

Identity players who stopped selling certainty

Who won:

Identity vendors who said:

“This improves probability — not truth.”

And backed it with:

transparent match logic

multiple identifiers

clean-room compatibility

Why they won:

After the cookie U-turn, certainty marketing lost credibility.

The “Still Standing, But Exposed”

ABM platforms stuck in CSV-era thinking

Still selling:

static account lists

quarterly refreshes

impression-led reporting

They didn’t collapse but they felt dated, fast

2025 exposed:

ABM without live signals is just expensive segmentation.

SEO & content platforms built for a pre-AI SERP

Not useless but suddenly incomplete.

The value shifted from:

“ranking help”

to:content distribution strategy

owned audience building

attribution beyond the click

2025 exposed:

SEO tools that stop at visibility are missing half the journey.

Intent data as a black box

Still widely used. Still valuable.

But no longer trusted in isolation.

Teams increasingly asked:

“Intent for what?”

“At which page?”

“Against which product?”

2025 exposed:

Directional intent without context is no longer enough.

The Losers (or at least, the models that cracked)

“One platform to rule them all” martech clouds

The pitch sounded great in 2020.

In 2025, it sounded risky.

Too slow to adapt.

Too opinionated about workflows.

Too brittle when one layer broke.

Why they lost ground:

The market moved faster than their release cycles.

Identity absolutists

Whether “cookies will save us” or “cookies are dead forever” — certainty didn’t age well.

The winners accepted ambiguity.

The losers sold absolutes.

AI tools without ownership

Copilots that:

didn’t own an outcome

didn’t reduce headcount or time

didn’t replace a workflow

Quickly fell into the “nice to have” bucket.

Why they lost:

2025 buyers asked harder questions.

Lead-gen platforms optimised for volume over truth

If your model relied on:

form fills without validation

inflated MQL counts

vanity conversion rates

2025 was uncomfortable.

Why they lost:

Sales teams finally pushed back — loudly.

The Meta Takeaway

2025 didn’t kill categories.

It killed lazy positioning.

Platforms won when they:

embraced uncertainty

integrated into composite stacks

optimised for signals, not stories

They lost when they:

oversold certainty

ignored how buyers actually behave

optimised for dashboards instead of decisions

One-line summary for the year

The winners didn’t promise clarity.

They delivered adaptability.

What to Do in January (the part most people skip)

If you do nothing else in January, do these four things:

1. Audit where your truth actually lives

Ask:

What tells us an account is warming?

Where is that signal captured?

Who trusts it? this is going to be huge in 2026

If the answer is “we look at a dashboard once a month”, fix that first.

2. Re-baseline your success metrics

If CTR, CPC, or impressions are still your north stars, you’re flying blind.

Replace them with:

engaged accounts

progression velocity

high-value actions per account

signal density over time

Engagement scoring to take a temperature reading for in-market activity

3. Decide what AI is for

Not “we should use AI”, but:

what workflow does it own?

what decision does it accelerate?

what risk does it introduce?

No job = no agent.

4. Treat identity as infrastructure, not strategy

Identity should enable things, not be the thing.

If your strategy slide starts with IDs instead of outcomes, invert it. IDs should be the enabler of outcomes not the be-all-end-all

The 2025 Mood Shift (LinkedIn vs Reddit)

LinkedIn in 2025

Optimistic about agents

Obsessed with stack simplification

Very excited about “operating models”

Reddit in 2025

“AI killed my traffic, now what?”

“Show me an agent that works in prod”

“None of this lines up with how my buyers behave”

Both were right.

Together, they tell the real story.

Fast Predictions for 2026

Short. Sharp. Directional.

2026 will be the year B2B finally operationalises signals

• Signals > impressions becomes default, not differentiated

• Identity sovereignty beats rented pipes

• Predictive beats personalised because personalised is over-hyped

• Composite stacks beat legacy clouds

• Attention beats clicks

• GTM Ops quietly outperforms everyone else

• ABX replaces ABM as the mental model

The companies that win won’t be louder. They’ll be faster at learning.

They’ll treat:

identity as infrastructure

signals as currency

AI as execution, not decoration

And they’ll stop waiting for platforms to save them.

Final thought

2025 didn’t give us clarity.

It removed excuses.

If you’re still measuring what’s easy instead of what matters,

still optimising distribution instead of outcomes,

still hoping the stack will stabilise on its own —

2026 will be uncomfortable.

If, on the other hand, you’re building a signal-led system that can adapt in real time…

You’re early.

If this was useful:

Follow The B2B Stack for daily Signals Pulse notes, long-form deep dives, and the frameworks we actually use to navigate this mess.

2026 is already moving.