The New B2B Account Graph: A Product Perspective on Targeting in 2025

Programmatic ad targeting is changing rapidly in light of cookies, privacy and working behaviours

The concept of the “Account Graph” is quietly becoming the most valuable infrastructure in B2B marketing. It’s the connective tissue that decides whether your Target Account List (TAL) becomes a signal engine - or just another spreadsheet collecting dust. As the identifiers behind the companies you target fragment, our product playbook has to change if we’re going to retain the ability to target them.

The internet is changing. LLM’s are emptying the content web reservoir and B2B research media is amongst the most effected content online. Gartner thinks SERPs will be down 25% in 2026 but perhaps most concerning is that the AI overviews we increasingly see in search and cutting click through rates by 79%. We now need to use identity to lift harder to identify B2B users in a smaller, shallower reservoir - which is where account and ID graphs come in

But here’s the kicker: most “graphs” out there are either glorified CSV joins (think: CRM email x ad cookie), or overengineered identity graphs built for consumer data - which break under B2B complexity.

This piece explores what the next-generation Account Graph looks like, how product teams should be thinking about it, and why it’s the key to unlocking scalable, cookieless, and precise B2B targeting.

1. Identity Resolution in B2B Has a Structural Problem

Consumer identity resolution relies on consistency: one user, multiple devices, stable login behavior, aided by fast path to purchase

B2B identity is messier:

Shared devices, office IPs and a lot of network noise

Multiple users per account

Form fills from “@gmail.com” or unrecognized domains

CRM records that lag or get siloed

Core data which changes fast - work emails last 12-24 months versus 7+ years for personal email. Layoffs, job changes and other churn mean B2B users often verifiably disappear overnight and take all their addressability with them - emails, devices, locations etc.

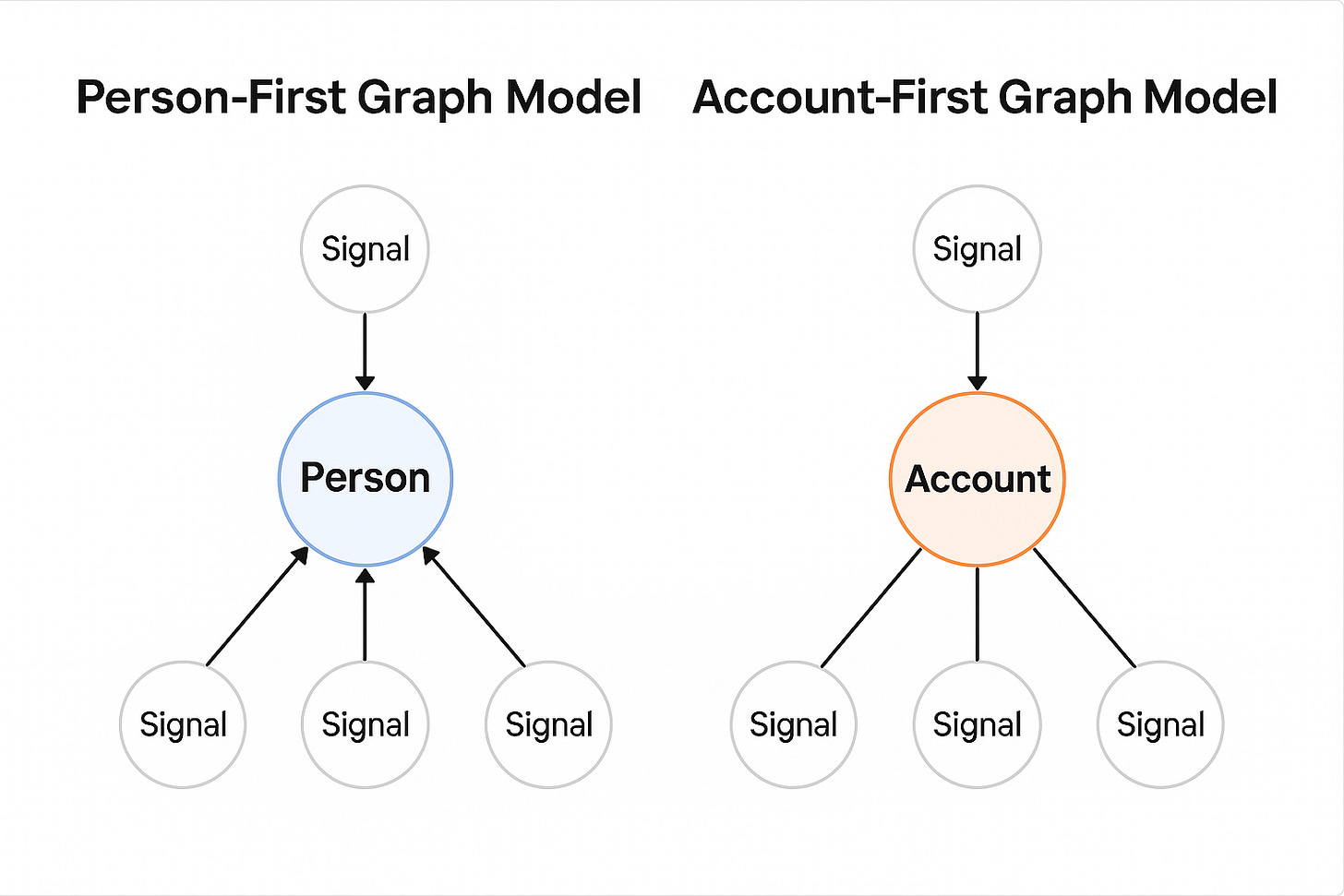

Product Insight: The B2B Account Graph must shift from person-first to account-first resolution. The goal is not to identify who filled the form - it’s to understand which account is active, engaged, and potentially in-market. The company layer brings significantly more stability - a more persistent base set of identifiers (IPs, email structure, location). It’s the business that buys in B2B even if it’s the human layer signing the paperwork

This gives our identity product a foundation in a world where Hubspot report that the B2B email decay rate is 25-30% a year and average tenure in the US is now just 18 months

Mapping to the company layer gives us a level of persistency in our core models, and we can add individual and persona level data into a deeper signal layer

2. The Real Pivot Is from Domain-Based to Company-Based Resolution

Most ABM systems still resolve identity by matching email or IP to a website domain. But domains are a weak identity proxy. They miss:

Subsidiaries and brand aliases

Global business units (e.g. abcgroup.com, abc.de)

Mismatches between buyer domains and parent companies

Product Insight: A modern Account Graph resolves to a company entity, not just a domain. This includes:

Mapping IPs, devices, and hashed emails to a corporate identity

Resolving group structures and brand families

Tracking behavior across related domains and sub-entities

Why Everyone Talks About Domains - And Why That’s Not Enough in 2025

In B2B identity resolution, domains are often treated as the core building block. It makes sense on the surface: most lead capture forms, CRM records, and programmatic targeting signals include an email or website domain. From ZoomInfo to LinkedIn to DSP match tables, domain-level matching has become the default approach.

But here’s the problem: a domain is not a company - it’s just one potential alias.

Why the Domain ≠ the Company

Companies operate with localized web presences: acme.fr, acme.de, acme-group.com and these are a Lot more complex then swapping the TLD for a localised version

They use email domains that don’t map directly to the brand: e.g. @acmelogistics.co.uk instead of @acme.com

Many accounts include subsidiaries and brand portfolios, especially in healthcare, finance, logistics, or manufacturing

Resellers and channel partners further muddy the signal

What this means: if your system is only matching exact strings (domain = abc.com), you’re missing vast swaths of engagement and intent happening under related domains.

The Product Leap: From Domains to Company-Based Resolution

Mapping identity to company entities, not just domains, unlocks a new level of precision and power.

Here’s what happens when you treat the company as the source of truth:

1.You Can Look Up Against Enrichment Partners More Effectively

Company-based resolution lets you tap into sources like IPFlow, Clearbit, Crunchbase, or Companies House more reliably

You’re no longer dependent on a single root domain - you can match against group-level identifiers, alternate names, and localized variants

You Gain Visibility Across Subsidiaries and Global Divisions

One multinational may have 30 domains across regions

Mapping at the company level lets you connect activity across those touchpoints - critical for geo-sensitive campaigns, GDPR compliance, or regional sales handoff

3.You Shift from String Matching to Signal Matching

IP data doesn’t always give you a clean domain - sometimes it’s ISP-level, or obfuscated. Networks, mobile carriers, VPNs and other security protocols add to the confusion. Cutting through the layers is challenging and gets harder where GDPR and other privacy laws increasingly break the 4 octet signal and make it unreliable

Knowing the company behind the domain lets you triangulate with location, email patterns, device clusters, and known office IP ranges - which realty equates to confidence scoring foundations

Instead of a binary match (yes/no), you can assign confidence scores that factor in multiple attributes. I thoroughly expect clients to start wanting to talk about this - because my observations to date are that people put their heads in the sand around the binary yes/no matching - a topic for another day

You Can Validate Against Your Ideal Customer Profile (ICP)

If you understand the company being targeted and not just the domain then you can overlay firmographics, vertical, revenue, headcount, and buying stage to validate the right company has been keyed

This lets you filter false positives (e.g. agency traffic, competitor research) and zero in on genuine buying signals

3. The Future Account Graph Is Multi-Signal and Feedback-Driven

Many “graphs” today are built once and updated quarterly. But B2B buying behavior shifts weekly even in our world of 9-18+ month sales cycles

The Account Graph of the future should:

Blend IP, hashed email, CRM data, cookie signals, intent, location, first party and web behavior signals

Operate with dynamic scoring and confidence models

Adjust in real-time based on performance data and analytics feedback - B2B moves slow UNTIL it starts to move fast, a concertina affect most likely caused by the lag between research and hand raising with vendors

Product Insight: This isn’t just identity resolution - it’s signal orchestration for the Omnichannel world. The graph needs to learn over time, not just store records.

4. The Account Graph Must Power Both Activation and Intelligence

Most teams treat identity resolution as a pre-campaign task: “Can I reach this account in media?” Essentially if I give you a list what is your match rate?

But the best product architectures use the Account Graph for:

Activation – precise targeting, suppression, and personalization

Intelligence – powering dashboards, scoring engagement, feeding SDR tools

Live feedback loop from intelligence layer to activation layer to make the targeting “live” and agile

Product Insight: Your Account Graph should serve both the DSP and the CRM. It’s not just a lookup — it’s a living decision layer.

5. Your Graph Is Your Moat - If You Build It Right

This has been my foundational belief in building FunnelFuel. Renting only gets you so far - to really turn up the heat I need to know the rules which combine signals, and exact inputs that drive the exact outputs. If I don’t have this, I can’t bring my own and my companies considerable B2B knowledge to bare in shaping the graph for the intricacies of B2B

Most companies license identity data from the same vendors: Bombora, ZoomInfo, IP targeting feeds, etc. That’s not a moat. Combining these sources cleverly puts a few shovel marks in the ground for sure, but a true identity solution must go deeper

Your moat is how you:

Combine these signals uniquely

Add unique data layers captured using your own technology - from logs to analytics - this gives you at least some Novel data to add into the mix

Develop proprietary match logic and scoring algorithms

Create internal IDs that unify cross-channel, cross-format data

Product Insight: Don’t just rent identity — engineer it. The best B2B platforms are building their own graph as an internal product with its own roadmap and feedback loops.

summary - the account graph playbook

Principle

Product Strategy

Account > Person

Focus on company-level signals and behavior

Company > Domain

Resolve to true business entities, not flat domains

Signals > Static

Blend and weight IP, email, CRM, cookies, and behavior

Learning > Lookup

Build confidence scoring, adjust with feedback

Intelligence + Activation

Power both media delivery and sales/analytics decision-making

Final Thought

If you’re building a media, data, or analytics product in 2025, your Account Graph isn’t just a targeting layer — it’s your identity engine, attribution backbone, and differentiation moat all rolled into one.

Most B2B marketers still treat identity as a checkbox. The opportunity is to treat it as a product — one that grows smarter over time and unlocks real scale.