The State of B2B Marketing 2025: The Year the Buyer Changed (Again)

As a year of exponential change draws to a close, a deep-dive into the ever evolving B2B buyers journey

“The buyer journey didn’t get shorter - it just got smarter.”

— Edelman & LinkedIn B2B Thought Leadership Impact Report 2025

As 2025 draws to a close, one truth stands out: the B2B buyer has evolved faster than the marketing models designed to reach them.

We are entering a new age of B2B marketing, where the playbook needs to be re-written - and darned fast!

Across every major study — from Edelman × LinkedIn to NetLine, Foundry, TechTarget, and IAB Europe — the story is the same: attention is scarce, trust is fragmented, and the buying committee looks more like a network than a funnel.

Here’s what the data says about how B2B audiences now consume, evaluate, and buy — and where we go next.

The Self-Directed Buyer Has Gone Global

“63 % of decision-makers now actively seek thought leadership before engaging a vendor — up 12 points from 2023.”

— Edelman × LinkedIn 2025 Impact Study

The modern buyer wants to teach themselves.

But how they learn varies wildly by region.

US & UK: prefer short, data-backed explainers and “snackable” insights that affirm expertise.

APAC: rewards long-form depth — webinars and deep-dive reports dominate in Singapore, India, and Australia.

EMEA: scepticism is rising; trust must be earned through peer or analyst co-signs, not logos alone.

Edelman’s report calls this the “Age of Self-Certainty” — where buyers don’t want persuasion, they want confirmation that their thinking is right.

👉 Translation: the top of funnel is no longer about discovery; it’s about validation.

2. The Buying Committee Is Now a Crowd

“The average B2B purchase involves 9.3 participants — up from 6.8 in 2022.”

— TechTarget / ESG 2025 Media Consumption & Vendor Engagement

Buying groups aren’t just larger — they’re looser.

Finance signs off. IT validates. Ops enforces reality.

Each persona consumes different media, often in parallel.

TechTarget notes a 24 % increase in multi-threaded research activity - meaning multiple team members downloading or viewing vendor content within 30 days of one another.

Yet, paradoxically, the time-to-decision hasn’t shortened.

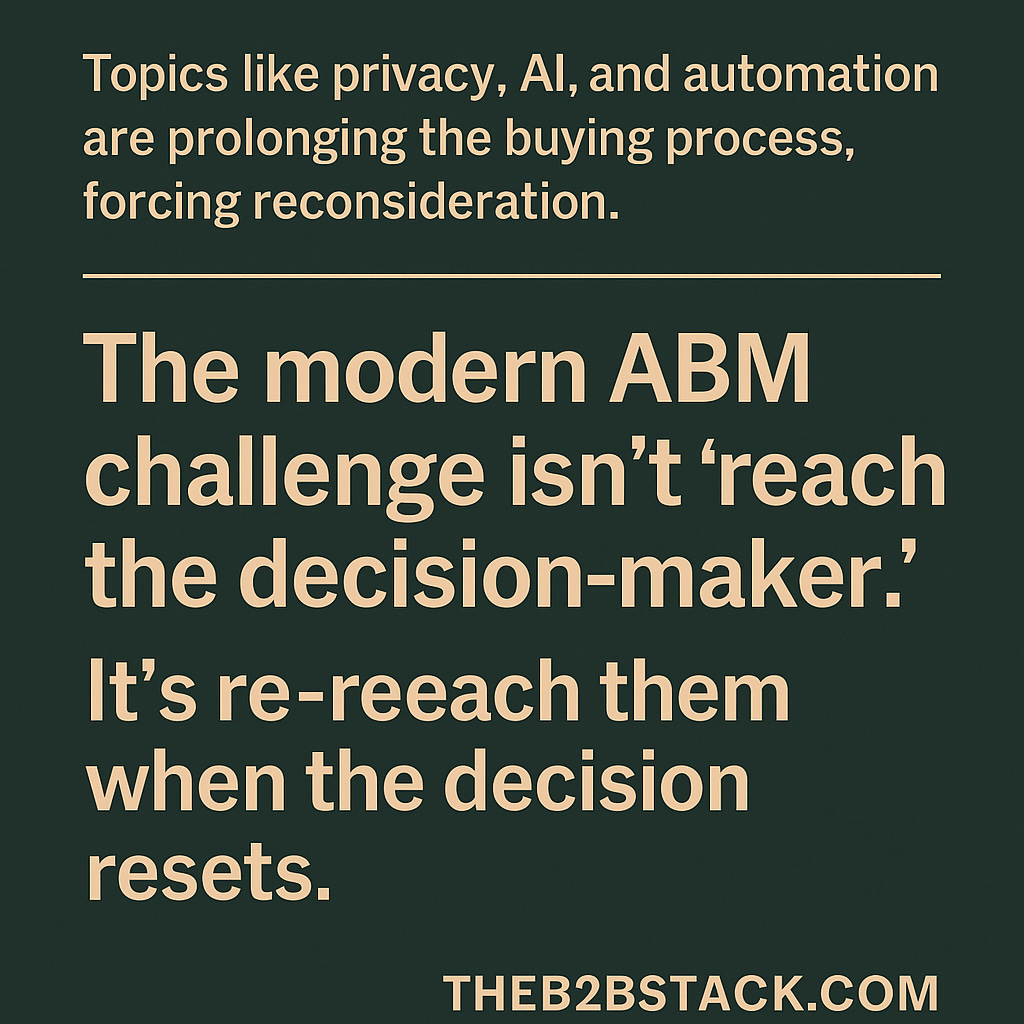

Instead, buying committees now loop back into research as new technologies (AI, automation, privacy) force fresh due diligence. Perhaps the rapid rate of change is driving higher degrees of buying committee uncertainty - where previously years of operational personal experience pulled for ITDMs, now it may be working against them. Topics like privacy, and the risk of getting on the wrong side of it, scare the best of us.

The modern ABM challenge isn’t “reach the decision-maker.”

It’s re-reach them when the decision resets.

3. Content Behaviour: The Great Fragmentation

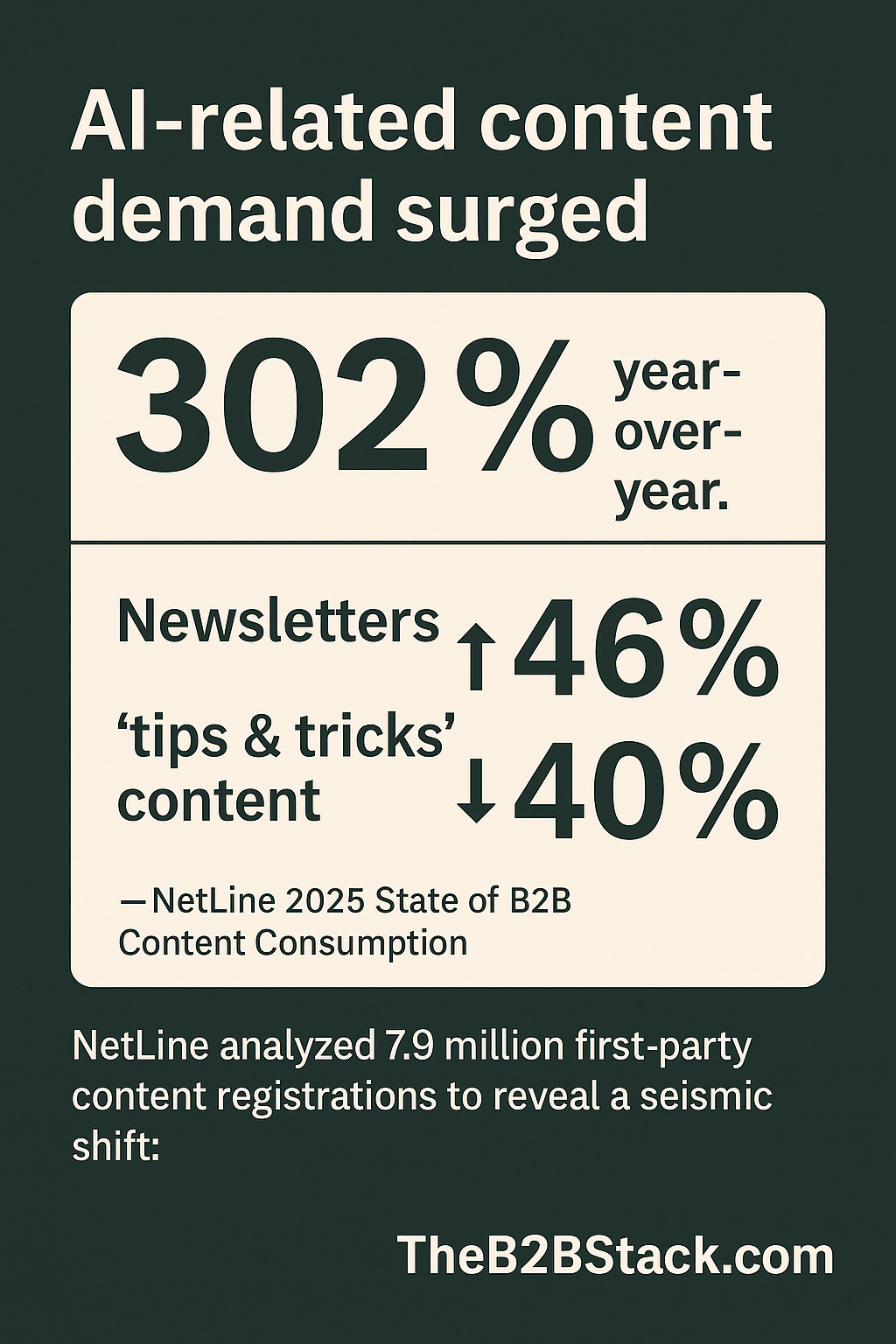

“AI-related content demand surged 302 % year-over-year.”

— NetLine 2025 State of B2B Content Consumption

“Newsletters ↑ 46 %, ‘tips & tricks’ content ↓ 40 %.”

NetLine analysed 7.9 million first-party content registrations to reveal a seismic shift:

Senior executives (VP +) now represent 65 % of total consumption.

The “consumption gap” — time from download to engagement — fell to 27 hours.

Demand for strategic narrative pieces (AI, transformation, leadership) far outpaced tactical “how-to” guides.

In short:

AI created urgency; executives created appetite.

The implication?

B2B content now performs more like financial news than marketing collateral — time-sensitive, insight-driven, and consumed top-down.

4. Regional & Cultural Nuance Is Back

“Decision-makers across APAC are 43 % more likely to attend live digital events if localised or regionally branded.”

— Foundry 11th Customer Engagement Study

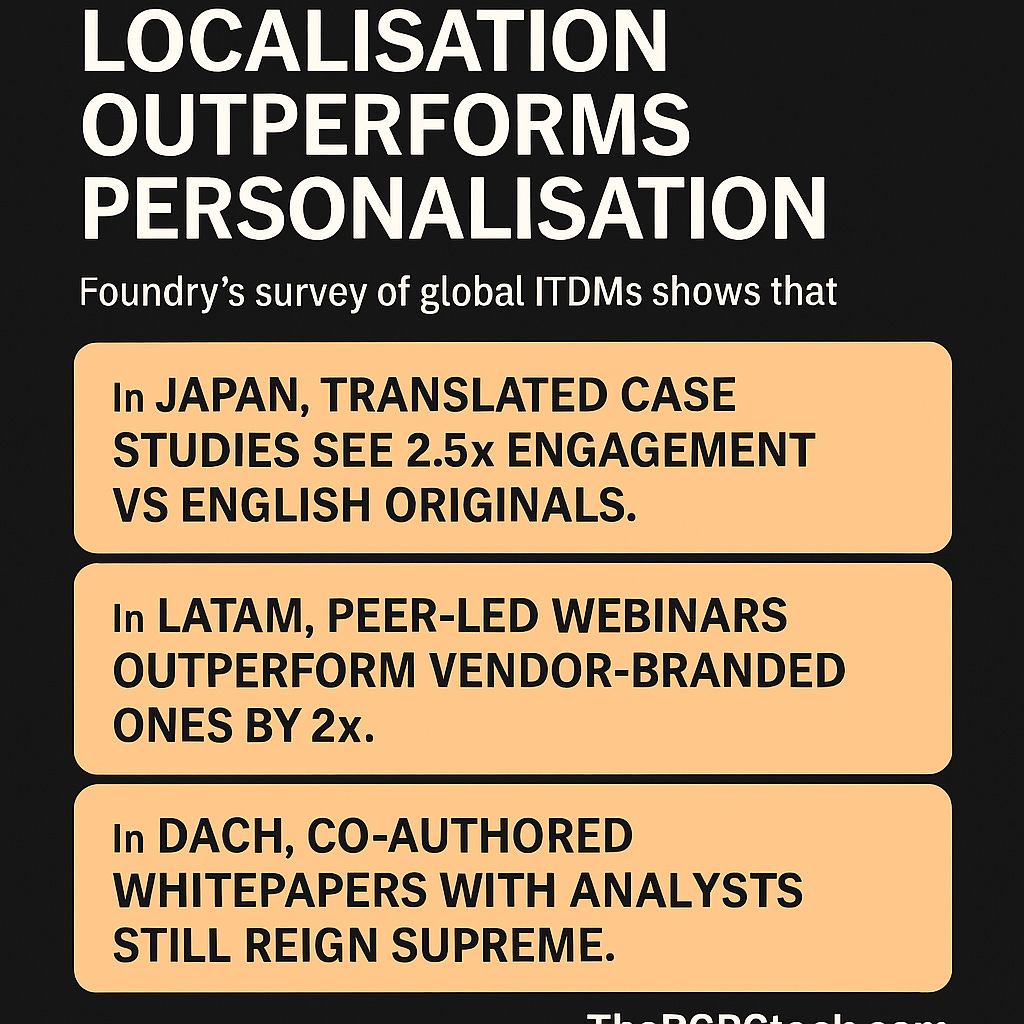

Foundry’s survey of global ITDMs shows that localisation outperforms personalisation.

In Japan, translated case studies see 2.5× engagement vs English originals.

In LATAM, peer-led webinars outperform vendor-branded ones by 2×.

In DACH, co-authored whitepapers with analysts still reign supreme.

The common theme:

“Context > Creative.”

Global consistency is overrated.

Cultural fluency is the new conversion rate.

The takeaway across what we have discussed so far remains that there are very real - and being maintained despite technological change - differences betwen major B2B regions, globally.

5. The Identity Crisis in Programmatic

“Only 31 % of advertisers report full transparency into where their programmatic ads appear.”

Spend is still climbing — up 22 % YoY — but confidence is slipping.

B2B advertisers face a double bind:

they need programmatic reach to scale ABM, but the identity fabric that powers it is fraying. In my opinion, programmatic has rarely been more important - a chance to leverage a bigger array of addressable channels then ever before, in the open interoperable internet, without the price inefficiencies of walled gardens. Yet the trust in the every fabric of its delivery is lacking - likely impacted by years of BS vendors over selling and under-delivering - often using outright lies.

Match-rates are down across major DSPs (particularly for SME TALs).

Data taxes and opaque mark-ups continue to inflate CPMs.

Attention metrics are replacing CTR, but implementation lags.

The smart money is moving toward curated supply + first-party signal loops — feeding High-Value Action (HVA) events from analytics back into DSP optimisation.

Programmatic isn’t dying; it’s evolving into a signal router.

6. The 2025 Playbook in Numbers

If you zoom out across the major analyst studies, the scale of change becomes obvious.

In 2022, the average B2B buying committee involved about 6.8 people.

In 2025, that number has climbed to 9.3, representing a 37 percent increase, according to TechTarget × ESG.

That’s not just more stakeholders; it’s more perspectives, more content touchpoints, and far more friction between discovery and decision.

Meanwhile, Edelman × LinkedIn reports that 63 percent of decision-makers now actively seek out thought leadership before ever speaking to a vendor — up 12 points from 2023.

The modern buyer no longer waits to be educated; they’re self-initiating the journey. This does all feel like it validates the increasing popularity of B2B influencer marketing - where expertise can be rented to aid credibility

Over on the content side, NetLine’s 2025 report found a 302 percent surge in demand for AI-related content, while tips-and-tricks formats fell sharply. These old ‘gamified’ SEO style tricks and clickbait (albeit B2B clickbait in this example) have been entirely superseded by LLM, where the user will simply ask for all the ‘tips and tricks’ they want and get a personalised response - the old formats are dead

The same dataset shows that newsletters are up 46 percent, proving that consistency now beats volume. Newsletters like TheB2BStack have grown rapidly - this one has gone from zero subscribers in August to nearly 700 today, and a community of B2B marketers who are paid subscribers looking for more nuanced help. This validates, on a tiny level, the appetite for specialised content which surfaces in the inbox - delivering a different form of discovery to the old search funnels

Regional data tells its own story. Foundry’s 11th Customer Engagement Study revealed that decision-makers across APAC are 43 percent more likely to attend digital events that are localised or regionally branded.

Global reach is easy; local resonance is the new competitive edge.

And when it comes to media spend, the cracks in the ecosystem are widening.

IAB Europe’s 2024 Attitudes to Programmatic report shows that 69 percent of advertisers cite transparency as a growing challenge — up from just a quarter a few years ago — while 42 percent say data-quality issues are increasing as cookies fade.

Despite that, overall programmatic investment rose 22 percent year-on-year. This to me makes sense - the changing fabric of the internet means that programmatic remains a scaled way to reach audiences, imperfect as it is.

Put simply: the committees are bigger, the content is sharper, the regions are diverging, and the ad pipes are creaking - yet spend, engagement, and opportunity are all still rising. Programmatic excels at casting a bigger account level net, which reflects the larger and harder to define buying committee

The conclusion? B2B hasn’t slowed down; it’s become multidimensional.

And 2026 will belong to the marketers who can align those dimensions — signal by signal, region by region, and channel by channel.

🧠 The B2B Stack Take

We’ve entered the Signal Era — where success isn’t about more impressions, it’s about better intent. Its about accepting that determinism has declined with cookies, and the best route forward is an account signals graph, which identifies multi-sources of signal class, overlaps them, and builds higher confidence in their efficacy

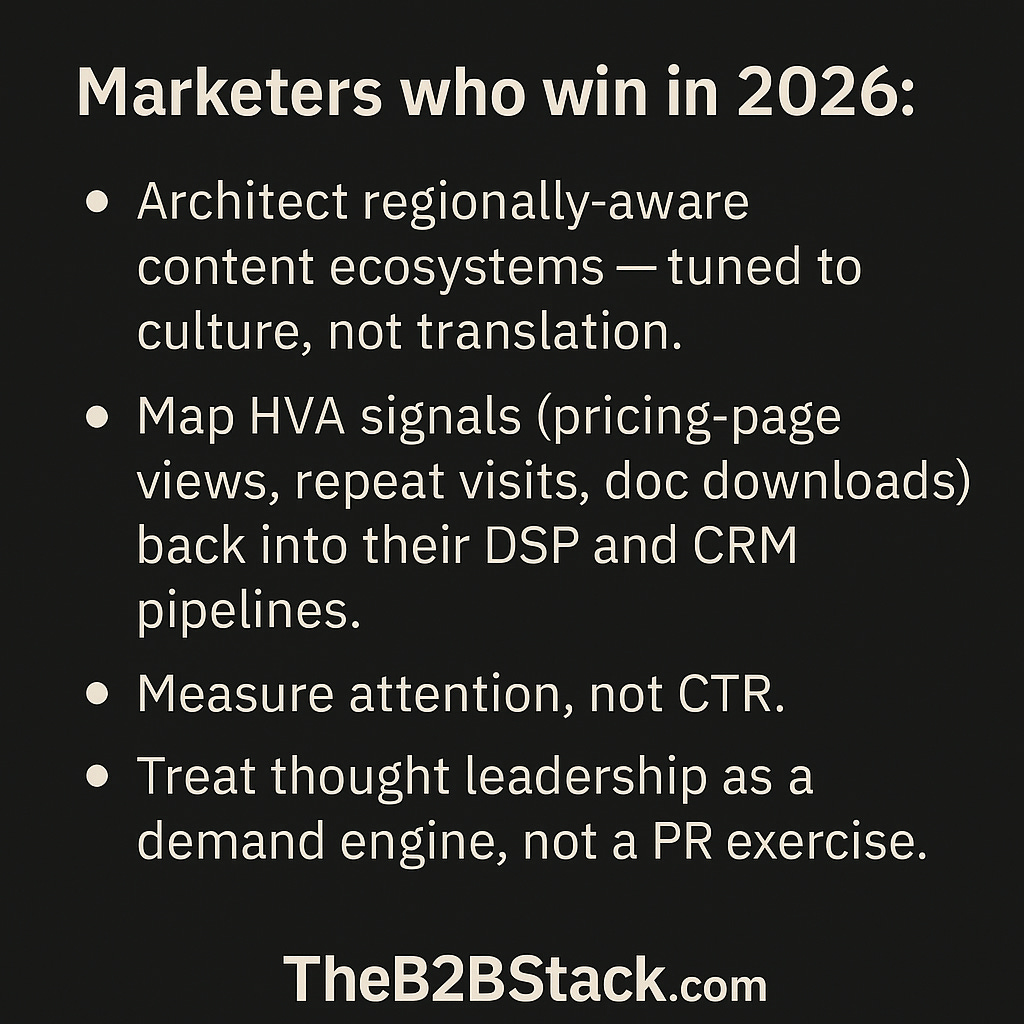

Marketers who win in 2026 will:

Architect regionally-aware content ecosystems — tuned to culture, not translation.

Map HVA signals (pricing-page views, repeat visits, doc downloads) back into their DSP and CRM pipelines.

Measure attention, not CTR.

Treat thought leadership as a demand engine, not a PR exercise.

The gap between media metrics and pipeline impact is closing — but only for those who unify content, identity, and analytics under one signal model.

🧠 Core Studies & Reports

1. Edelman × LinkedIn — B2B Thought Leadership Impact Study (2025)

https://www.edelman.com/research/b2b-thought-leadership-impact-study

2. NetLine — 2025 State of B2B Content Consumption and Demand Report

https://www.netline.com/resources/state-of-b2b-content-consumption-report/

3. TechTarget × ESG — 2025 Media Consumption & Vendor Engagement Report

https://www.techtarget.com/resources/

(See ESG / TechTarget joint research under “Reports & Resources”)

4. Foundry — 11th Annual Customer Engagement Study (2025)

https://foundryco.com/research/

5. IAB Europe — Attitudes to Programmatic Advertising 2024

https://iabeurope.eu/research-thought-leadership/

🧩 Supporting Research

6. SWZD (Spiceworks Ziff Davis) — 2025 State of IT Report

https://www.spiceworks.com/marketing/state-of-it-report/

7. TechTarget BrightTALK — B2B Engagement & Intent Benchmark Reports

https://business.brighttalk.com/resources/

8. HubSpot — 2024 State of Marketing Report

https://www.hubspot.com/state-of-marketing

9. Demand Gen Report — 2025 Content Preferences Survey

https://www.demandgenreport.com/resources/

🧾 Recommended Supplemental Reads

(These reinforce the same buyer-behaviour trends)

Gartner — 2024 B2B Buying Journey Report

https://www.gartner.com/en/marketing/research/b2b-buying-journeyForrester — The Evolving B2B Buying Landscape 2024

https://www.forrester.com/report/the-evolving-b2b-buying-landscape/RES178202Content Marketing Institute — 2024 B2B Content Marketing Benchmarks

https://contentmarketinginstitute.com/research/

💯💯

Cool