From Data Rich to Revenue Ready: Why Speed Is the New Advantage in B2B Growth

It’s not about more leads — it’s about moving from buyer intent → engagement → outcome faster than your competitor. Here’s how to do that

B2B teams aren’t losing because they’re data-poor. They’re losing because they’re slow.

Slow to identify buying groups.

Slow to activate signals.

Slow to orchestrate media.

Slow to measure.

Slow to align internally.

And in 2026, slow is no longer a workflow inconvenience — it is your largest, most invisible source of pipeline loss.

The industry is finally naming the problem out loud.

The Shift: Speed Is the New Moat

For the last decade, the B2B mantra was simple:

“More tools, more data, more signals.”

And it worked… until it didn’t.

The martech stack ballooned.

Identity expanded.

Intent exploded.

Signals multiplied.

But one thing never changed:

The time it takes most teams to act.

Meanwhile, buyers have become faster, noisier, and harder to correlate.

The buying group is fluid.

The journey is non-linear.

Anonymous sessions hide real intent spikes.

Dark social and programmatic impressions move faster than dashboards.

This is the new reality:

Data is no longer the competitive advantage.

Speed is.

Teams win not because they know more but because they reduce the time from:

Signal → Activation → Pipeline → Revenue.

That velocity is the real moat.

And the market has just proved it.

The Wake-Up Call: This Week’s Marketing Week Bombshell

Marketing Week published one of the most honest B2B autopsies of the year:

“B2B pressure leads marketers to sacrifice quality in favour of quantity.”

(https://www.marketingweek.com/b2b-pressure-leads-quantity/)

Their findings are damning:

56% of B2B marketers are forced into volume over quality

46% say speed is the #1 barrier to doing great work

Teams are stuck in “always-on execution mode”

Quality drops because workflow bottlenecks dominate

Strategic thinking evaporates when systems can’t move fast enough

But the real insight — which the article implies but doesn’t say outright — is this:

Marketers default to quantity because their systems cannot activate quality signals fast enough.

When identity is fragmented, data is stale, signals are siloed, campaigns take weeks, approvals take longer…

the only lever left is busywork.

The article is devastating not because it’s negative —

but because it’s true.

Slow systems create bad marketing.

Fast systems create strategic marketing.

Authority Check: Every Analyst & Vendor Is Saying the Same Thing

This isn’t just a Marketing Week problem.

It’s the industry’s problem.

And every influential source is converging on the same conclusion:

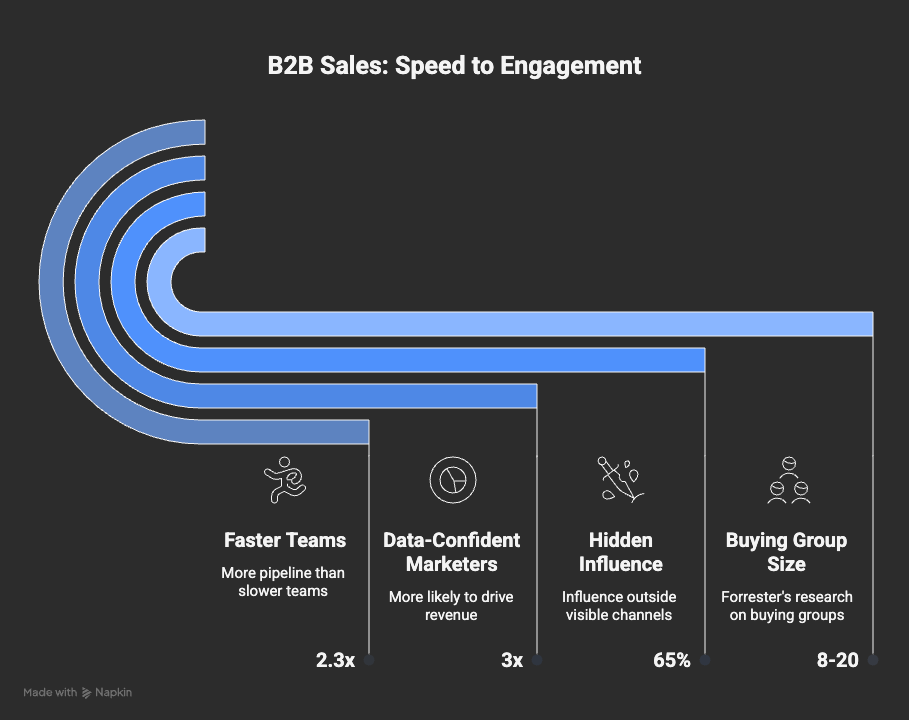

IDC

IDC reports that teams who activate intent data within 48 hours generate 2.3× more pipeline than slower teams.

Forrester

Forrester’s Buying Group Revolution highlights that buying groups are now 8–20 people, fluid across channels, and require real-time orchestration — not static lists.

LinkedIn + Edelman

Their “Hidden Buyers” research shows that up to 65% of influence happens outside visible channels — requiring faster identity, intent and media alignment.

MadisonLogic

Their research on buying-group personas reveals 8 distinct roles in complex B2B deals — each producing different, time-sensitive signals.

Anteriad + Ascend2

Data-confident marketers are 3× more likely to drive revenue — not because of the data itself, but because confidence increases the speed of action.

DemandGen Report

82% of B2B organisations say “speed to engagement” is now the #1 predictor of pipeline conversion.

AdExchanger / MarTech / The Drum

Analysts agree the adtech ecosystem is shifting toward:

curated supply

identity-led bidding

signal-based sequencing

and AI-assisted activation

All of which reward speed, not volume.

The story is consistent across every credible publisher:

The winners in 2026 won’t be the most data-rich.

They’ll be the fastest to act on the data.

Why B2B Is Slow: The Bottlenecks No One Fixes

Speed isn’t only a cultural problem.

It’s an architectural one.

Here are the hidden structural blockers slowing your GTM engine:

1. Identity Fragmentation

Identity is fragmented across:

CRM

MAP

website analytics

ad platforms

enrichment tools

ABM suites

programmatic logs

The result:

Your brightest signals enter dark rooms.

This alone creates days of friction.

2. Signal Silos

Intent → analytics → CRM → MAP → outreach → DSP → SDR

= six layers of bottlenecks.

Signals degrade with time.

Every hour counts.

Most systems take days.

3. Tool Sprawl

The average B2B martech stack contains 19–37 tools (DigitalBloom, 2025).

Every handoff slows velocity.

More tools = less speed.

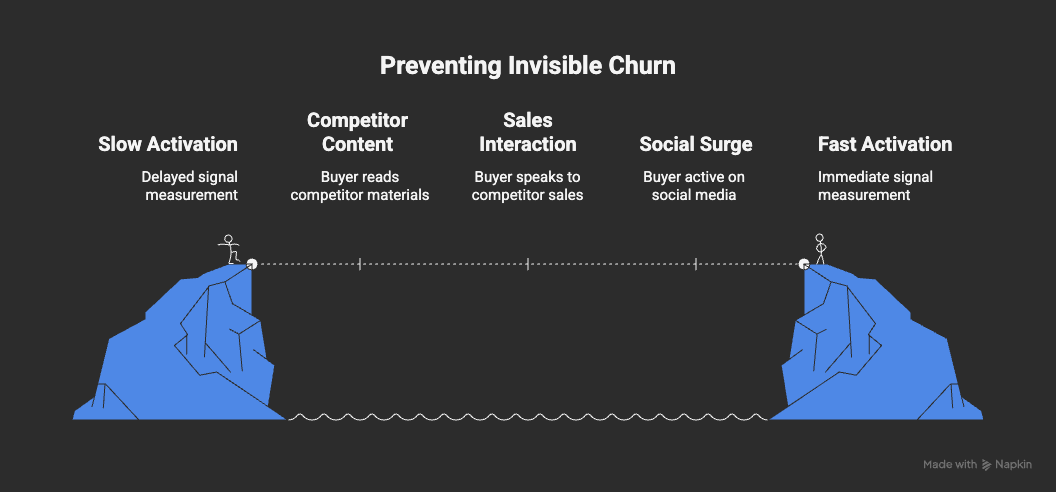

4. Activation Lag

Signals are often detected today…

activated next week…

and measured next quarter.

By then, your buyer has:

read competitor content

spoken to sales

surged on social

hit other websites

taken a demo elsewhere

Slow activation = invisible churn.

5. Workflow Debt

Most GTM workflows were built between 2015–2020 —

optimised for lead gen, not buying groups.

Today’s buyers need real-time, multi-layer activation.

Legacy workflows can’t deliver it.

6. Measurement Blind Spots

Teams move slowly because:

they can’t measure the right signals

attribution is delayed

pipelines aren’t connected

buying groups aren’t resolved

If you can’t see the truth fast, you can’t act fast.

Introducing The Signal Spine — The Architecture of GTM Speed

This is the operating system that today’s ABM suites, DSPs and CRMs do not provide natively.

The Signal Spine is the backbone that finally connects:

identity

intent

behavioural signals

programmatic exposure

media activation

sales engagement

and measurement

into a single velocity engine.

Layer 1 — Identity Resolution

Account → Buying Group → Persona → Session → Device

Speed is impossible without identity clarity.

Layer 2 — Behavioural Intelligence

High Value Actions (HVAs)

Recency models

Page intent classification

Session pathways

Buying-group heatmaps

This is the heartbeat of modern ABM.

Layer 3 — Intent Fusion Layer

Topic intent

Competitor intent

Search intent

Contextual consumption

Programmatic impressions

Category surge

Recency/decay scoring

Intent is useless if not fused and ranked.

Layer 4 — Programmatic Signal Layer

Open-web media intelligence:

impressions → matches → frequency → exposure logs → creative influence

This layer reveals buying-group movements before CRM ever sees them.

Layer 5 — Activation Orchestration

Workflows that launch within hours:

LinkedIn

programmatic

outbound

nurturing

sales alerts

personalised content

cross-account triggers

This is the layer legacy ABM tools struggle with the most.

Layer 6 — Measurement & Feedback

A 24–48 hour loop, not quarterly post-mortems.

This is where revenue teams discover velocity — or lose it.

Real Examples: Slow vs Fast GTM

Slow Team

Intent surge detected Monday.

CRM updated Wednesday.

SDR alerted Friday.

Programmatic launched Tuesday.

Deal lost Wednesday — buyer had already engaged with a competitor.

Fast Team

Intent surge detected Monday.

Identity resolved instantly.

DSP + LinkedIn + outbound activated within hours.

Sales engaged same day.

Deal won.

It wasn’t better content.

It was better speed.

The 2026 Playbook: Becoming a Speed-First GTM Org

Here’s the part the market reports can’t give you.

1. Build Your Signal Spine First

Not more tools — more architecture.

2. Reduce Time-to-Activation

Move from intent → activation in hours, not days.

3. Align Media + Sales

Programmatic warms buying groups.

Sales closes them.

Orchestration = speed.

4. Install Speed KPIs

Time-to-signal

Time-to-activation

Time-to-engagement

Time-to-pipeline

Buying-group velocity

Signal decay curves

5. Kill Tools That Add Drag

If it slows activation, it dies.

Founder Reflection

This week’s Marketing Week stat hit hard:

“46% of B2B marketers say speed is their #1 barrier to doing great work.”

I’ve seen the same thing every day.

The biggest wins in my own systems didn’t come from more data —

they came from removing drag.

One architectural shift.

One identity spine.

One activation layer.

And suddenly pipeline accelerates.

It took me a decade to realise something so simple:

B2B doesn’t have a data problem.

It has a speed problem.

And the fastest team wins.

💬 What to Ask GPT Next

A new idea of mine, some prompt guidance to help you continue exploring this further

“Using the B2B stack Signal Spine model, design a GTM architecture that reduces our time-to-activation by 70%.”

“Audit our ABM stack and identify where we’re defaulting to quantity because of slow activation.”

“Build a 90-day speed-acceleration plan using the KPIs in this post.”

“Map our current buying-group signals and identify the fastest activation paths.”

“Create a workflow that activates programmatic + LinkedIn + outbound within 2 hours of an intent surge.”

Thanks for sharing mike Hart 😊