This Week in B2B: Announcements + News + Curation + Attention + ABM’s Timing Problem

Vendor spin vs operator reality across CTV, curation, ABM, identity, and deals.

What mattered in B2B this week, across adtech, ABM, identity, GTM, and buyer behaviour — and how to think about it.

🚨 This Week’s Macro Signal

B2B stacks are optimising harder — yet yet learning slower

This week had the familiar “we’re back” energy: curation, attention metrics, agentic AI for ABM, and another set of vendor promises about performance partnerships.

But the real signal wasn’t the announcements. It was the gap between:

what platforms claim is measurable now, and

what operators say they can actually prove in the wild

This is the early 2026 paradox: more tooling, more signals, more automation — but slower conviction.

Receipts (macro context):

Digiday – Agencies push curation upstream, reclaiming control of the programmatic bidstream – https://digiday.com/marketing/agencies-push-curation-upstream-reclaiming-control-of-the-programmatic-bidstream/

The Media Leader – The next wave of curation and media quality – https://uk.themedialeader.com/the-next-wave-of-curation-and-media-quality/

Advertising Week – 2026 Predictions: Curation will redraw the programmatic map – https://advertisingweek.com/2026-predictions-curation-will-redraw-the-programmatic-map/

Basis – 7 Programmatic Advertising Trends Shaping 2026 – https://basis.com/blog/7-programmatic-advertising-trends-shaping-2026

Fast Takes (Vendor Spin vs Operator Reality)

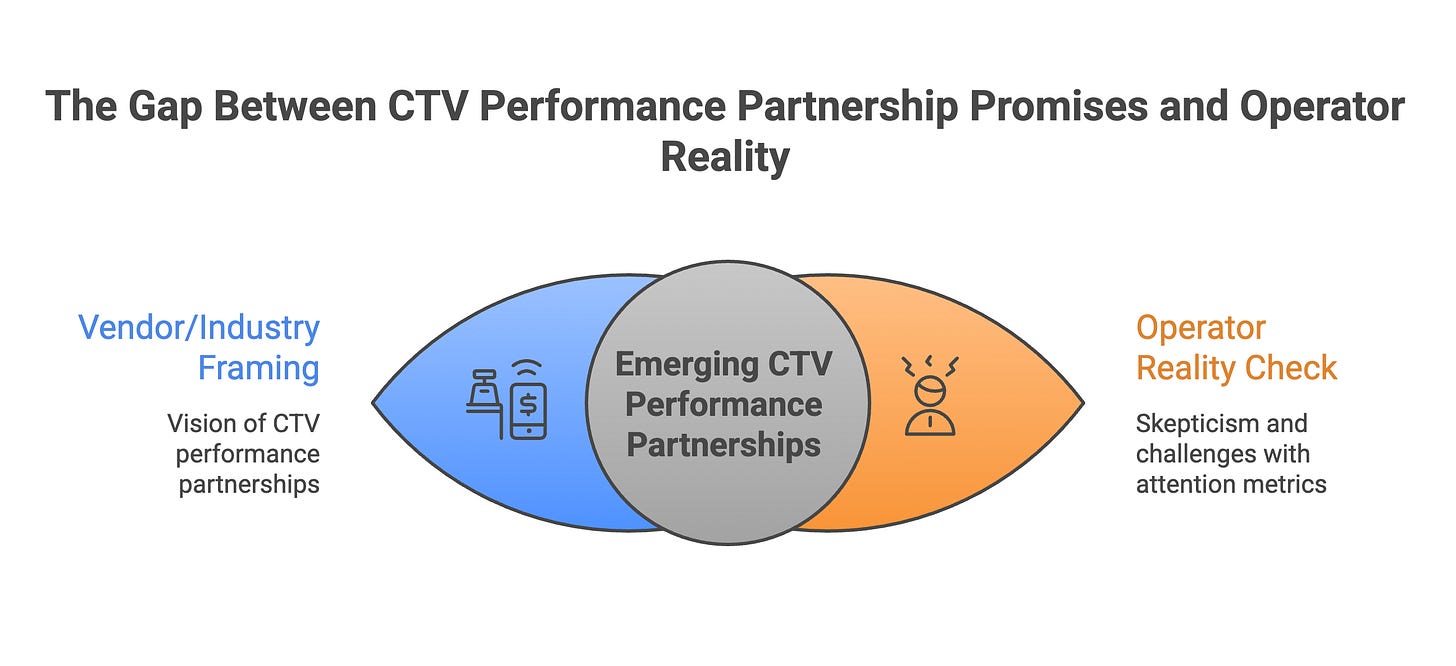

1) 📺 CTV + Attention: “Performance-ready” …if you change the homework

CTV is still the most important channel where measurement ideology is diverging from measurement reality.

Vendor / industry framing:

CTV is moving into “performance partnerships” and shared KPIs (attention, engagement, conversion).

Advertising Week – 2026 Predictions: CTV and Adtech’s New Era of Performance Partnerships – https://advertisingweek.com/2026-predictions-ctv-and-adtechs-new-era-of-performance-partnerships/

Operator reality check (Reddit):

Attention metrics are being actively debated; some see correlation, others see weak linkage depending on goal + setup. The premise of attention metrics is strong, but there does seem to be some vendor fluff. Viewability as a concept should only ever have been a stepping stone, its too flawed to be anything else, yet attention metrics has failed so far to steal its thunder. They are supposed to be Viewability 2.0, but as we can see below, real operators are not consistently seeing the value yet

r/programmatic – Has anyone been asked about attention metrics… – https://www.reddit.com/r/programmatic/comments/xpzmgj/has_anyone_been_asked_about_attention_metrics_or/

r/adops – Moving beyond impressions and CTR – https://www.reddit.com/r/adops/comments/xtr6ix/moving_beyond_impressions_and_ctr/

r/programmatic – Measuring CTV to Outcomes – https://www.reddit.com/r/programmatic/comments/1mohxed/measuring_ctv_to_outcomes/

r/programmatic – Where should I be buying CTV ads (for performance)? – https://www.reddit.com/r/programmatic/comments/1iwje28/where_should_i_be_buying_ctv_ads_for_performance/

The real riff:

CTV “works” when you judge it like demand infrastructure (attention → memory → later behaviour), not like last-click display. The reason teams argue about it is simple: most stacks are still grading CTV with the wrong exam paper.

This is not unusual in programmatic in general, where metrics remain one of the biggest single pain points, period. Welcome to the game television!

2) 🧱 Curation is becoming the new control plane

If 2024–2025 was “curation confusion”, this week reinforced that 2026 is “curation as strategy”. I have been very bullish on curation for a long time, but its not been an easy topic to take peers on a journey around.

For me, Curation is about signal hygiene, maximum pre-QPS-filtered scale, and shaping audiences closer to the signal. The long roadmap is margin reclaim and the potential to migrate beyond the DSP, limited by curated DealIDs, and to tap into these higher fidelity audiences using agentic workflows. Mainly because B2B lacks the hardcore direct response requirements of B2C BUT does need valid ways to construct bigger, cleaner audience pools

Agency + trade narrative:

Curation is moving upstream so agencies can regain control of supply and outcomes (and of course margins).

Digiday – Agencies push curation upstream… – https://digiday.com/marketing/agencies-push-curation-upstream-reclaiming-control-of-the-programmatic-bidstream/

Publisher / open web angle:

Curation is being positioned as the way the open web competes again — by aligning media quality + environment + outcomes.

Advertising Week – Curation will redraw the programmatic map – https://advertisingweek.com/2026-predictions-curation-will-redraw-the-programmatic-map/

The Media Leader – The next wave of curation and media quality – https://uk.themedialeader.com/the-next-wave-of-curation-and-media-quality/

The real riff:

Curation is quietly becoming what “algorithms” were supposed to be:

a repeatable way to encode media beliefs (quality, context, attention, performance) into buying paths, without the fluff, with a nice dose of supply path optimisation (SPO) and margin grab in the mixer too.

The winners won’t be the teams with “more deals.”

They’ll be the teams with an opinionated curation system — and the measurement layer to validate it. Less is more and spend concentration is required here, so the battle grounds between the likes of OpenX, Index Exchange, Magnite et al will be huge this year. I’m hoping for some big innovation

3) 🎯 ABM is shifting from “select accounts” → “detect state changes”

This week’s ABM discourse kept circling the same pain: static lists vs dynamic buying reality.

Evidence in LinkedIn publishing:

LinkedIn Pulse – ABM Without Guesswork: How Agentic AI Makes Targeting Smarter – https://www.linkedin.com/pulse/abm-without-guesswork-how-agentic-ai-makes-targeting-smarter-low-euusc

LinkedIn Pulse – Before Your Competitors Deploy Agentic AI, Read This… – https://www.linkedin.com/pulse/before-your-competitors-deploy-agentic-ai-read-p-ollitt-bqxuc

Benchmarks / practitioner distribution:

ZenABM – LinkedIn ABM Performance Benchmarks Report 2026 – https://zenabm.com/blog/linkedin-abm-performance-benchmarks-report-2026

LinkedIn post sharing the report – https://www.linkedin.com/posts/emiliakorczynska_actionable-linkedin-abm-performance-benchmarks-activity-7412815100539076608-bcvP

The real riff:

ABM’s problem isn’t “does it work?”

It’s that ABM has been run like a quarterly planning exercise in a world that’s gone real-time.

Next-gen ABM won’t just be “better TAL hygiene.” - however important this is.

It will be state detection: accounts rising/falling based on live behavioural evidence — and creative + channel orchestration responding accordingly.

I was talking about this on LinkedIn earlier this week, click on the screenshot below to join the conversation

4) Identity is less about IDs now — it’s about the decision layer

The identity conversation keeps drifting away from “which ID” toward “who controls signal interpretation.”

I’m bored to death of unique IDs now. A solution that didn’t scale and caused more headache trying to bridge and combine them. Agencies have been buying up ID solutions to build their own walled garden audience pools around, such as Publicis buying Lotame in mid 2025.

Real-world reference point (agency-led identity consolidation):

Publicis press release – Publicis to acquire Lotame – https://www.publicisgroupe.com/en/news/press-releases/publicis-to-acquire-lotame-the-world-s-leading-independent-end-to-end-data-solution

Digiday – Publicis Groupe to buy Lotame… – https://digiday.com/media-buying/publicis-groupe-to-buy-lotame-in-a-rare-instance-of-agency-led-ad-tech-consolidation/

AdExchanger – Publicis acquires Lotame… – https://www.adexchanger.com/agencies/publicis-acquires-lotame-marking-the-end-for-one-of-ad-techs-evolutionary-wonders/

Reuters – Publicis to acquire data group Lotame… – https://www.reuters.com/business/media-telecom/publicis-acquire-data-group-lotame-double-individual-profiles-4-billion-2025-03-06/

The real riff:

Identity or at least identifiers isn’t the moat. Decisioning is the moat.

IDs are pipes. Signals are fuel.

The advantage comes from the logic that decides: what matters, what to ignore, and what to do next. That is the real engine, OS, smart logic layer versus scaling an ID into the bidstream in 2026

5) Vendor announcement of the week: Attention hits the sell-side curation layer

This one caught my eye because it’s not just “attention as a report” — it’s attention as a tradable input into curated supply.

Adelaide (Press Release, Jan 7 2026) – Adelaide Joins Index Marketplaces, Bringing Attention-Based Media Quality To Sell-Side Curation – https://www.adelaidemetrics.com/news

This AdExchanger piece gives more context to Index Exchange and their marketplaces concept – Index Exchange is betting on curated deals (Index Marketplaces launch context) – https://www.adexchanger.com/online-advertising/as-the-open-web-wobbles-index-exchange-is-betting-on-curated-deals/

Index Exchange (LinkedIn) – Introducing the Index Exchange Data Vendor Ecosystem – https://www.linkedin.com/posts/index-platform_introducing-the-index-exchange-data-vendor-activity-7381315783995367425-d40_

The real riff:

When attention becomes a curation input, the game shifts from “optimise creative” to “optimise supply paths.”

That’s a structural change and B2B should care because it maps to quality environments + real engagement, not cheap reach.

6) 💸 M&A / Deals: Commerce-media gravity is pulling adtech sideways

A clean example of “data company moves into media capability”:

AdExchanger – SPINS moves into media with MikMak acquisition – https://www.adexchanger.com/commerce/cpg-data-seller-spins-moves-into-media-with-mikmak-acquisition/

AdExchanger – A rundown of (pretty much) every ad tech deal of 2025 – https://www.adexchanger.com/platforms/a-rundown-on-pretty-much-every-ad-tech-deal-of-2025/

The real riff:

The market is rewarding businesses that collapse distance between:

data → decisioning → activation. This gets to the core of ABM problems with static list to activation, if we want a B2B example. Collapsing the signal to activation here is where you land on an ABM OS vs a dusty CSV based quarterly refresh approach. There’s similar headwinds across commerce media and wider adtech, B2B is not alone here.

Point is tools are getting squeezed. Integrated “signal-to-action” systems are getting bought.

Pattern of the Week

The stack is shifting from “optimising channels” to “engineering demand”

Old question: Which channel performed best?

New question: Which signals changed behaviour — and how do we create more of those signals next week?

That’s the quiet shift:

media plans → systems

attribution → learning velocity

campaign success → behavioural progression

The best stacks aren’t “bigger.” They’re more opinionated — with receipts.

What smart teams do next week (actionable, not motivational)

Define 5–10 HVAs that represent real buying progress (not proxy engagement)

Build a simple “state model” (cold → warming → active → in-market) at account level

Use CTV + open web curation to create upstream demand — but grade it on attention + downstream lift, not clicks

Reduce your dashboard surface area: fewer metrics, higher meaning, more focus on WTF do we do next based on what is happenING not just what happenED

📌 One line to steal

“In modern B2B, audiences aren’t the input, they’re the output of behaviour.”

ADDITIONAL READING & SOURCES

Digiday – https://digiday.com/marketing/agencies-push-curation-upstream-reclaiming-control-of-the-programmatic-bidstream/

The Media Leader – https://uk.themedialeader.com/the-next-wave-of-curation-and-media-quality/

Advertising Week (Curation) – https://advertisingweek.com/2026-predictions-curation-will-redraw-the-programmatic-map/

Advertising Week (CTV perf partnerships) – https://advertisingweek.com/2026-predictions-ctv-and-adtechs-new-era-of-performance-partnerships/

Adelaide News – https://www.adelaidemetrics.com/news

AdExchanger (SPINS / MikMak) – https://www.adexchanger.com/commerce/cpg-data-seller-spins-moves-into-media-with-mikmak-acquisition/

AdExchanger (2025 deal rundown) – https://www.adexchanger.com/platforms/a-rundown-on-pretty-much-every-ad-tech-deal-of-2025/

LinkedIn Pulse (ABM agentic AI) – https://www.linkedin.com/pulse/abm-without-guesswork-how-agentic-ai-makes-targeting-smarter-low-euusc

LinkedIn Pulse (Agentic AI + account intelligence) – https://www.linkedin.com/pulse/before-your-competitors-deploy-agentic-ai-read-p-ollitt-bqxuc

ZenABM benchmarks – https://zenabm.com/blog/linkedin-abm-performance-benchmarks-report-2026

LinkedIn benchmarks post – https://www.linkedin.com/posts/emiliakorczynska_actionable-linkedin-abm-performance-benchmarks-activity-7412815100539076608-bcvP

Reddit (attention metrics debate) – https://www.reddit.com/r/programmatic/comments/xpzmgj/has_anyone_been_asked_about_attention_metrics_or/

Reddit (move beyond impressions/CTR) – https://www.reddit.com/r/adops/comments/xtr6ix/moving_beyond_impressions_and_ctr/